Authors

Summary

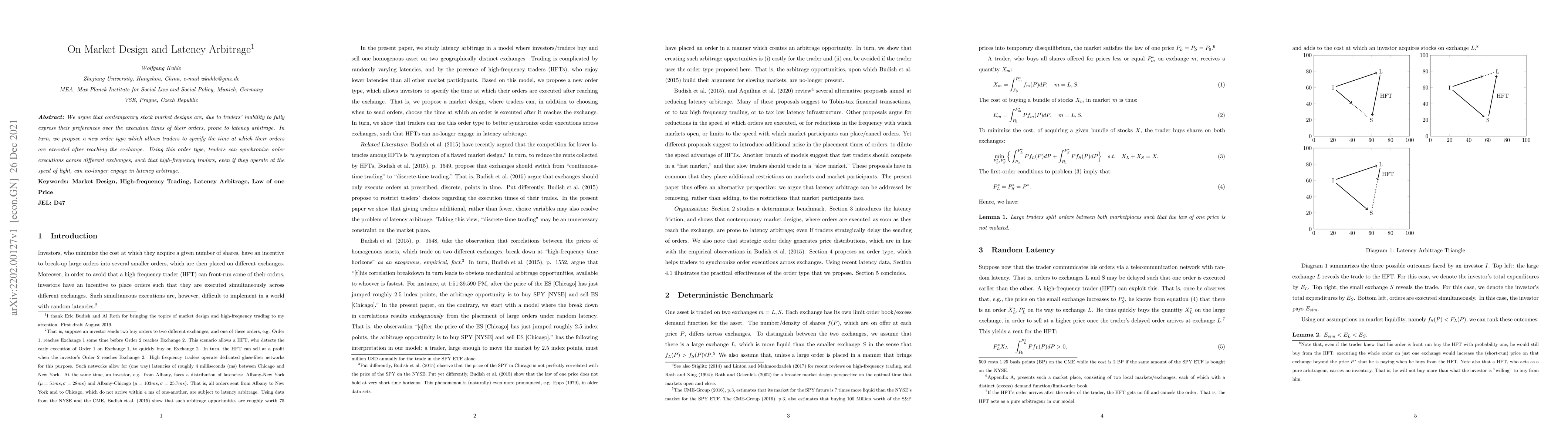

We argue that contemporary stock market designs are, due to traders' inability to fully express their preferences over the execution times of their orders, prone to latency arbitrage. In turn, we propose a new order type which allows traders to specify the time at which their orders are executed after reaching the exchange. Using this order type, traders can synchronize order executions across different exchanges, such that high-frequency traders, even if they operate at the speed of light, can no-longer engage in latency arbitrage.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)