Summary

In this paper, we introduce two alternative extensions of the classical univariate Value-at-Risk (VaR) in a multivariate setting. The two proposed multivariate VaR are vector-valued measures with the same dimension as the underlying risk portfolio. The lower-orthant VaR is constructed from level sets of multivariate distribution functions whereas the upper-orthant VaR is constructed from level sets of multivariate survival functions. Several properties have been derived. In particular, we show that these risk measures both satisfy the positive homogeneity and the translation invariance property. Comparison between univariate risk measures and components of multivariate VaR are provided. We also analyze how these measures are impacted by a change in marginal distributions, by a change in dependence structure and by a change in risk level. Illustrations are given in the class of Archimedean copulas.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

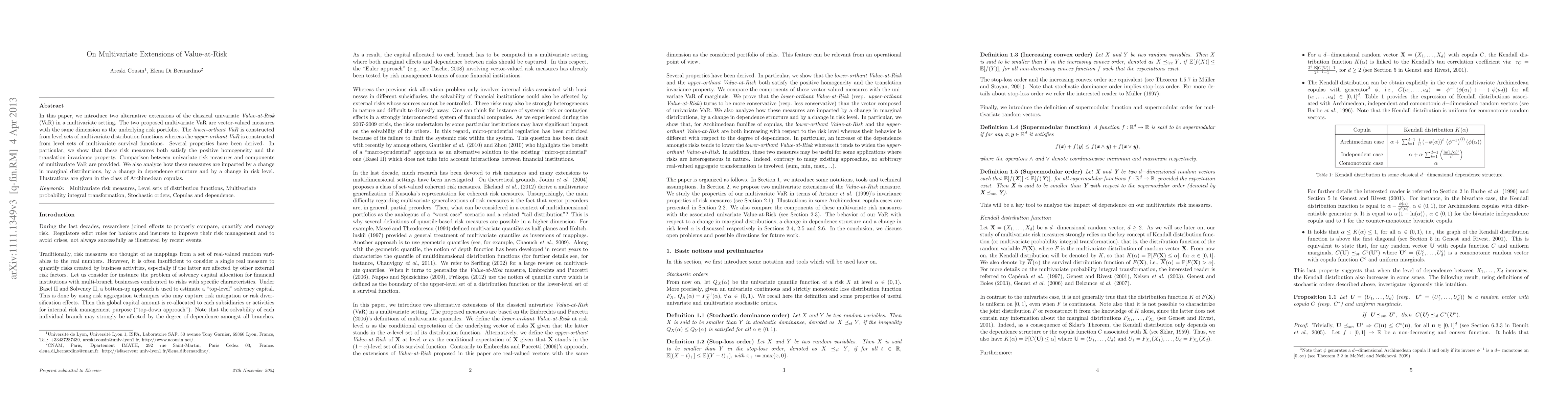

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)