Summary

In this paper, we study the Nash dynamics of strategic interplays of n buyers in a matching market setup by a seller, the market maker. Taking the standard market equilibrium approach, upon receiving submitted bid vectors from the buyers, the market maker will decide on a price vector to clear the market in such a way that each buyer is allocated an item for which he desires the most (a.k.a., a market equilibrium solution). While such equilibrium outcomes are not unique, the market maker chooses one (maxeq) that optimizes its own objective --- revenue maximization. The buyers in turn change bids to their best interests in order to obtain higher utilities in the next round's market equilibrium solution. This is an (n+1)-person game where buyers place strategic bids to gain the most from the market maker's equilibrium mechanism. The incentives of buyers in deciding their bids and the market maker's choice of using the maxeq mechanism create a wave of Nash dynamics involved in the market. We characterize Nash equilibria in the dynamics in terms of the relationship between maxeq and mineq (i.e., minimum revenue equilibrium), and develop convergence results for Nash dynamics from the maxeq policy to a mineq solution, resulting an outcome equivalent to the truthful VCG mechanism. Our results imply revenue equivalence between maxeq and mineq, and address the question that why short-term revenue maximization is a poor long run strategy, in a deterministic and dynamic setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

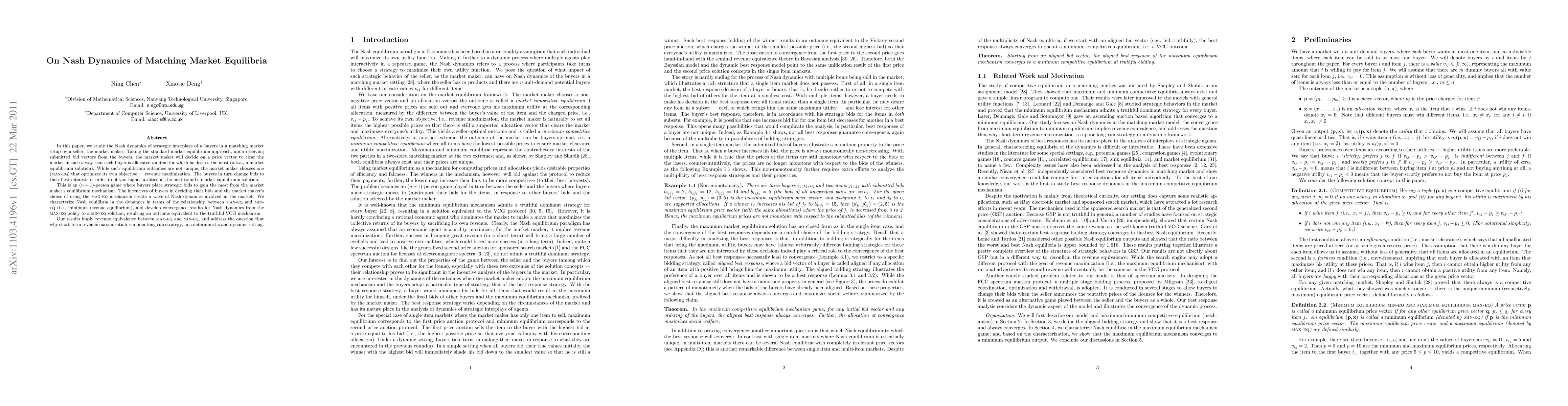

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNash implementation in a many-to-one matching market

Noelia Juarez, Jorge Oviedo, Paola B. Manasero

| Title | Authors | Year | Actions |

|---|

Comments (0)