Summary

We pose an optimal control problem arising in a perhaps new model for retirement investing. Given a control function $f$ and our current net worth as $X(t)$ for any $t$, we invest an amount $f(X(t))$ in the market. We need a fortune of $M$ "superdollars" to retire and want to retire as early as possible. We model our change in net worth over each infinitesimal time interval by the Ito process $dX(t)= (1+f(X(t))dt+ f(X(t))dW(t)$. We show how to choose the optimal $f=f_0$ and show that the choice of $f_0$ is optimal among all nonanticipative investment strategies, not just among Markovian ones.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

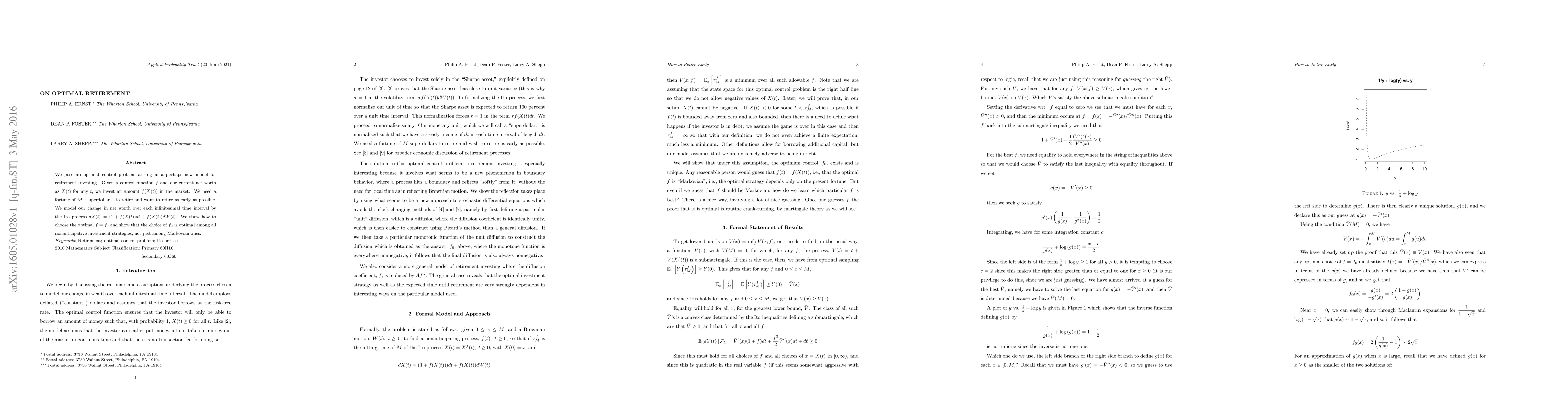

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIncome Disaster, Role of Income Support, and Optimal Retirement

Tae Ung Gang, Yong Hyun Shin, Seyoung Park

Impact Of Income And Leisure On Optimal Portfolio, Consumption, Retirement Decisions Under Exponential Utility

Tae Ung Gang, Yong Hyun Shin

Optimal Investment, Heterogeneous Consumption and Best Time for Retirement

Harry Zheng, Zuo Quan Xu, Hyun Jin Jang

No citations found for this paper.

Comments (0)