Summary

We consider the optimal dividend problem for the insurance risk process in a general Levy process setting. The objective is to find a strategy which maximizes the expected total discounted dividends until the time of ruin. We give sufficient conditions under which the optimal strategy is of barrier type. In particular, we show that if the Levy density is a completely monotone function, then the optimal dividend strategy is a barrier strategy. This approach was inspired by the work of Avram et al. (2007) [Annals of Applied Probability 17, 156-180], Loeffen (2008) [Annals of Applied Probability 18, 1669-1680] and Kyprianou et al. (2010) [Journal of Theoretical Probability 23, 547-564] in which the same problem was considered under the spectrally negative Levy processes setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

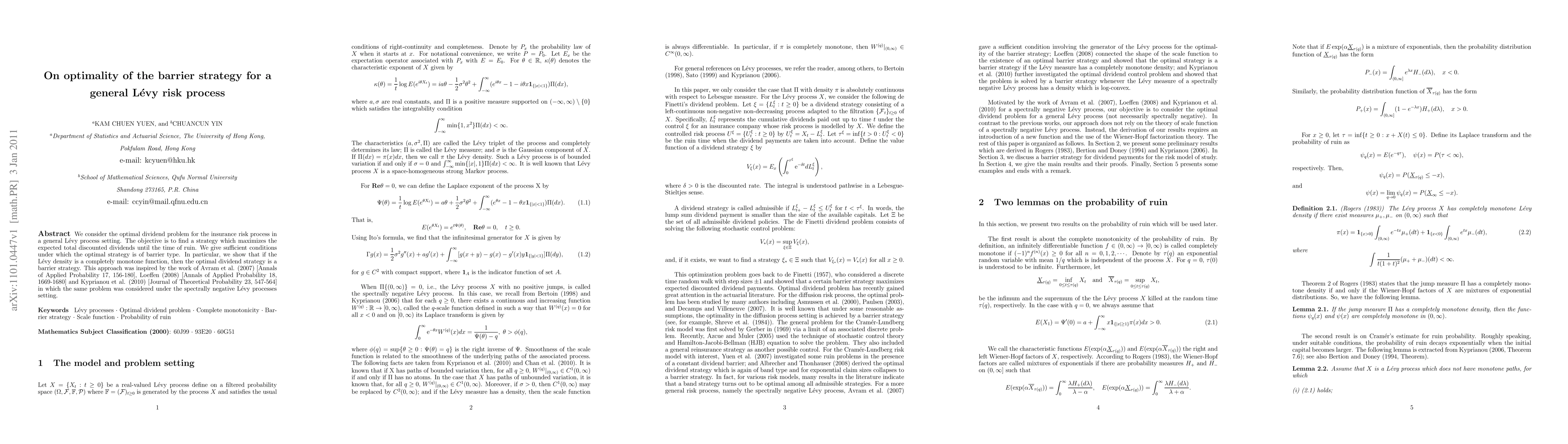

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)