Authors

Summary

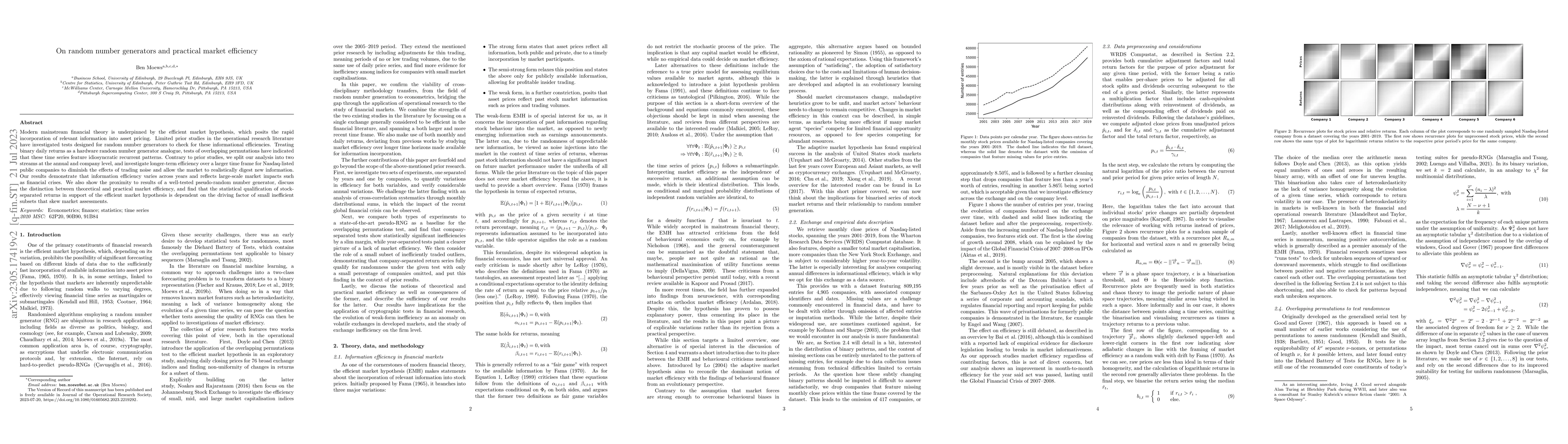

Modern mainstream financial theory is underpinned by the efficient market hypothesis, which posits the rapid incorporation of relevant information into asset pricing. Limited prior studies in the operational research literature have investigated tests designed for random number generators to check for these informational efficiencies. Treating binary daily returns as a hardware random number generator analogue, tests of overlapping permutations have indicated that these time series feature idiosyncratic recurrent patterns. Contrary to prior studies, we split our analysis into two streams at the annual and company level, and investigate longer-term efficiency over a larger time frame for Nasdaq-listed public companies to diminish the effects of trading noise and allow the market to realistically digest new information. Our results demonstrate that information efficiency varies across years and reflects large-scale market impacts such as financial crises. We also show the proximity to results of a well-tested pseudo-random number generator, discuss the distinction between theoretical and practical market efficiency, and find that the statistical qualification of stock-separated returns in support of the efficient market hypothesis is dependent on the driving factor of small inefficient subsets that skew market assessments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantum Random Number Generators : Benchmarking and Challenges

Gorka Muñoz-Gil, Maciej Lewenstein, Tobias Graß et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)