Summary

We consider the problem of representing claims for coherent risk measures. For this purpose we introduce the concept of (weak and strong) time-consistency with respect to a portfolio of assets, generalizing the one defined by Delbaen. In a similar way we extend the notion of m-stability, by introducing weak and strong versions. We then prove that the two concepts of m-stability and time-consistency are still equivalent, thus giving necessary and sufficient conditions for a coherent risk measure to be represented by a market with proportional transaction costs. We go on to deduce that, under a separability assumption, any coherent risk measure is strongly time-consistent with respect to a suitably chosen countable portfolio, and show the converse: that any market with proportional transaction costs is equivalent to a market priced by a coherent risk measure, essentially establishing the equivalence of the two concepts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

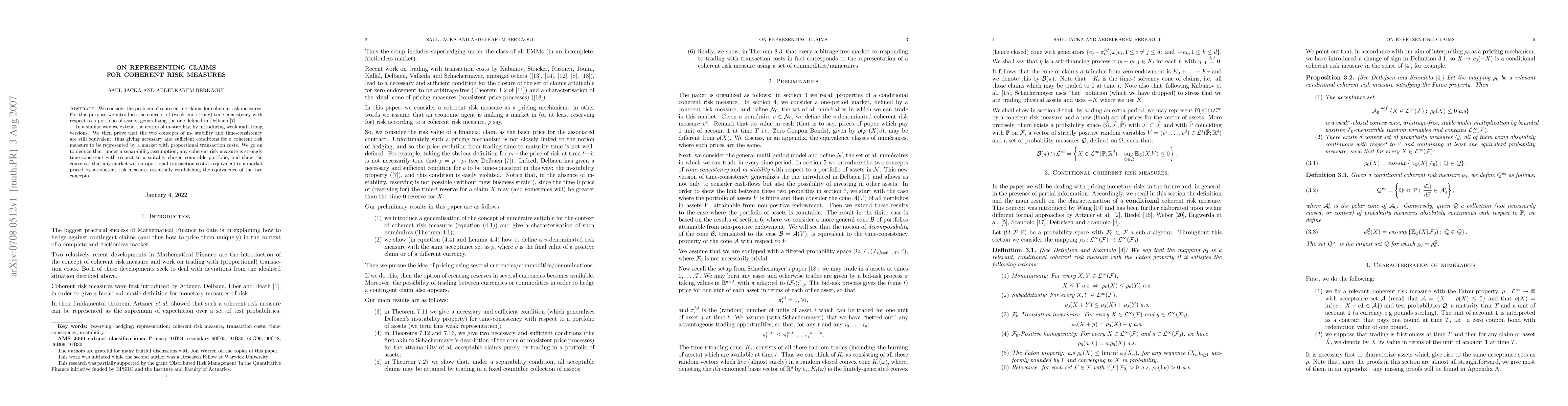

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersESG-coherent risk measures for sustainable investing

W. Brent Lindquist, Svetlozar T. Rachev, Rosella Giacometti et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)