Summary

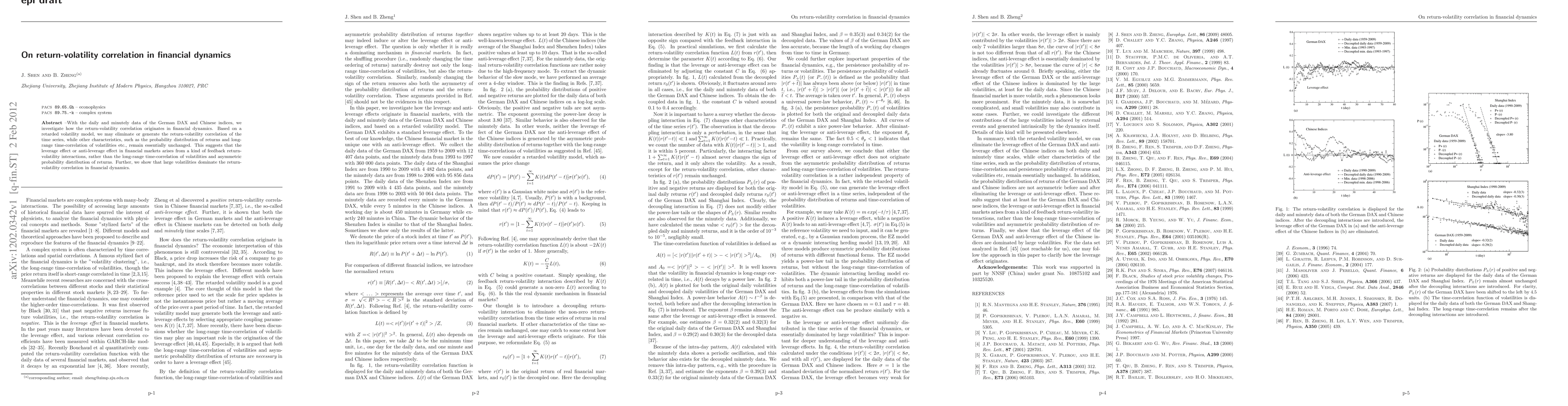

With the daily and minutely data of the German DAX and Chinese indices, we investigate how the return-volatility correlation originates in financial dynamics. Based on a retarded volatility model, we may eliminate or generate the return-volatility correlation of the time series, while other characteristics, such as the probability distribution of returns and long-range time-correlation of volatilities etc., remain essentially unchanged. This suggests that the leverage effect or anti-leverage effect in financial markets arises from a kind of feedback return-volatility interactions, rather than the long-range time-correlation of volatilities and asymmetric probability distribution of returns. Further, we show that large volatilities dominate the return-volatility correlation in financial dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)