Summary

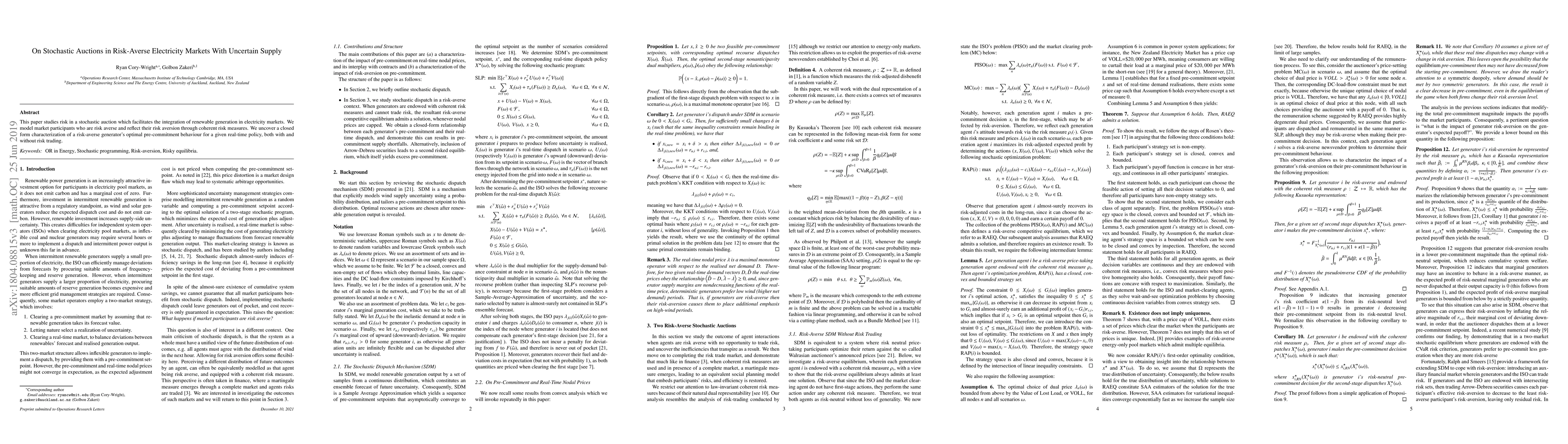

This paper studies risk in a stochastic auction which facilitates the integration of renewable generation in electricity markets. We model market participants who are risk averse and reflect their risk aversion through coherent risk measures. We uncover a closed form characterization of a risk-averse generator's optimal pre-commitment behaviour for a given real-time policy, both with and without risk trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)