Authors

Summary

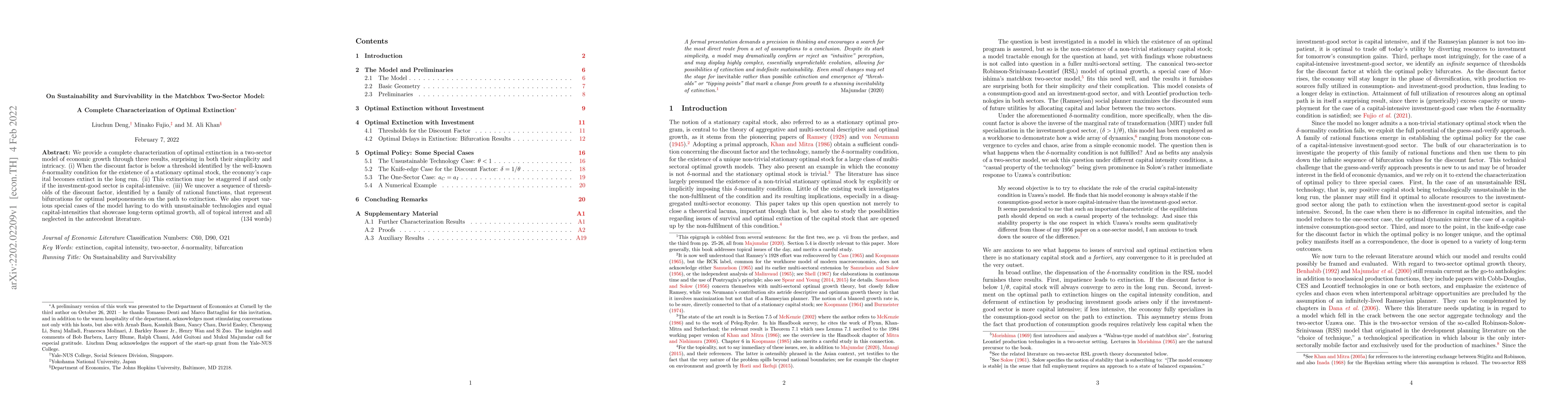

We provide a complete characterization of optimal extinction in a two-sector model of economic growth through three results, surprising in both their simplicity and intricacy. (i) When the discount factor is below a threshold identified by the well-known $\delta$-normality condition for the existence of a stationary optimal stock, the economy's capital becomes extinct in the long run. (ii) This extinction may be staggered if and only if the investment-good sector is capital intensive. (iii) We uncover a sequence of thresholds of the discount factor, identified by a family of rational functions, that represent bifurcations for optimal postponements on the path to extinction. We also report various special cases of the model having to do with unsustainable technologies and equal capital intensities that showcase long-term optimal growth, all of topical interest and all neglected in the antecedent literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)