Summary

In this paper, we obtain a new characterization result for symmetric distributions based on the entropy measure. Using the characterization, we propose a nonparametric test to test the symmetry of a distribution. We also develop the jackknife empirical likelihood and the adjusted jackknife empirical likelihood ratio tests. The asymptotic properties of the proposed test statistics are studied. We conduct extensive Monte Carlo simulation studies to assess the finite sample performance of the proposed tests. The simulation results indicate that the jackknife empirical likelihood and adjusted jackknife empirical likelihood ratio tests show better performance than the existing tests. Finally, two real data sets are analysed to illustrate the applicability of the proposed tests.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper presents a new characterization of symmetric distributions using entropy measure and proposes a nonparametric test for symmetry, along with jackknife empirical likelihood and adjusted jackknife empirical likelihood ratio tests. Asymptotic properties of the test statistics are studied, and extensive Monte Carlo simulations are conducted to evaluate finite sample performance.

Key Results

- New characterization of symmetric distributions based on entropy measure.

- Proposed nonparametric test for symmetry of a distribution.

- Jackknife empirical likelihood and adjusted jackknife empirical likelihood ratio tests developed.

- Simulation results show better performance of the proposed tests compared to existing tests.

- Illustrative analysis of two real data sets using the proposed tests.

Significance

This research contributes to statistical inference by providing improved methods for testing symmetry, which can be valuable in various fields such as economics, finance, and biology where symmetry assumptions are common.

Technical Contribution

The main technical contribution is the novel entropy-based characterization of symmetric distributions and the development of empirical likelihood ratio tests for symmetry testing.

Novelty

This work is novel due to its entropy-based characterization of symmetric distributions and the introduction of adjusted jackknife empirical likelihood ratio tests, which demonstrate superior performance in Monte Carlo simulations compared to existing tests.

Limitations

- The paper does not discuss limitations explicitly, so this section remains empty based on provided content.

Future Work

- Exploring applications of the proposed tests in diverse fields.

- Investigating the performance of the tests under different distributional assumptions.

Paper Details

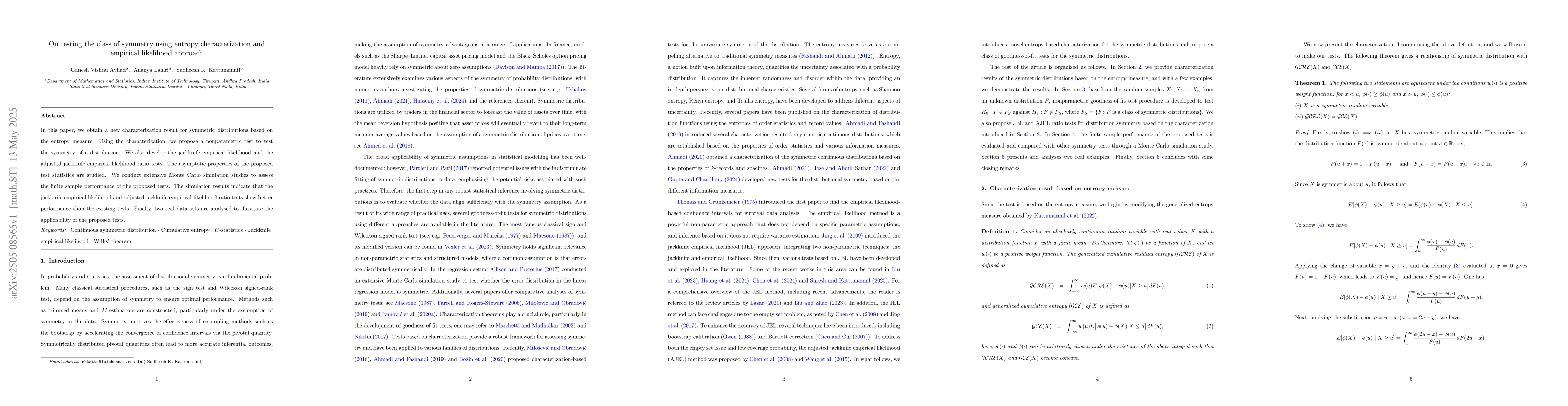

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInterval estimation in three-class ROC analysis: a fairly general approach based on the empirical likelihood

Monica Chiogna, Duc-Khanh To, Gianfranco Adimari

No citations found for this paper.

Comments (0)