Summary

We consider an information-based model in which the flow of information about an event of interest (bankruptcy, decision, ...) occurring at a future random time $\tau$ is modelled with the completed filtration generated by a Brownian bridge with random length $\tau$ and pinning point $Z$. Assuming that the distribution of $\tau$ is absolutely continuous with respect to the Lebesgue measure, following P.-A. Meyer approach, we provide the explicit computation of the compensator of the indicator process $\mathbb{I}_{[\tau,\infty)}$. Moreover, by exploiting special properties of the bridge process we also give the explicit expression of the compensator of the process $Z\,\mathbb{I}_{[\tau,\infty)}$.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper extends the information-based asset pricing framework of Brody, Hughston & Macrina by integrating a default scenario for the underlying issuer, modelling information flow over a potentially random time horizon contingent on default occurrence before a fixed future time T.

Key Results

- Explicit computation of the compensator of the indicator process I{[τ,∞)} and the process ZI{[τ,∞)} with respect to a market filtration generated by a Brownian bridge information process.

- Derivation of stochastic differential equations satisfied by the price process using the canonical decomposition of the market information process ζT.

- Explicit computation of the compensator of the random time ν = τ ∧ T, demonstrating its total inaccessibility with respect to the filtration FζT.

Significance

This research is significant as it enhances the modelling of financial markets by incorporating a default scenario, which is crucial for accurate pricing and risk assessment of financial instruments. The explicit computation of compensators and derivation of SDEs contribute to a deeper understanding of information flow dynamics in financial markets.

Technical Contribution

The paper presents explicit computations of compensators for certain special processes and derives stochastic differential equations for the price process, leveraging the canonical decomposition of the market information process.

Novelty

The research extends existing information-based asset pricing models by incorporating a default scenario, explicitly computing compensators of specific processes, and demonstrating the total inaccessibility of a random time, contributing novel insights into financial information flow dynamics.

Limitations

- The model assumes specific properties of the underlying asset and information process, which may limit its applicability to more complex or diverse financial instruments.

- The paper does not address potential computational challenges in implementing the derived models in real-world financial applications.

Future Work

- Investigate the applicability of the model to a broader range of financial instruments and market conditions.

- Explore computational methods and algorithms to efficiently implement the derived models in practical financial applications.

Paper Details

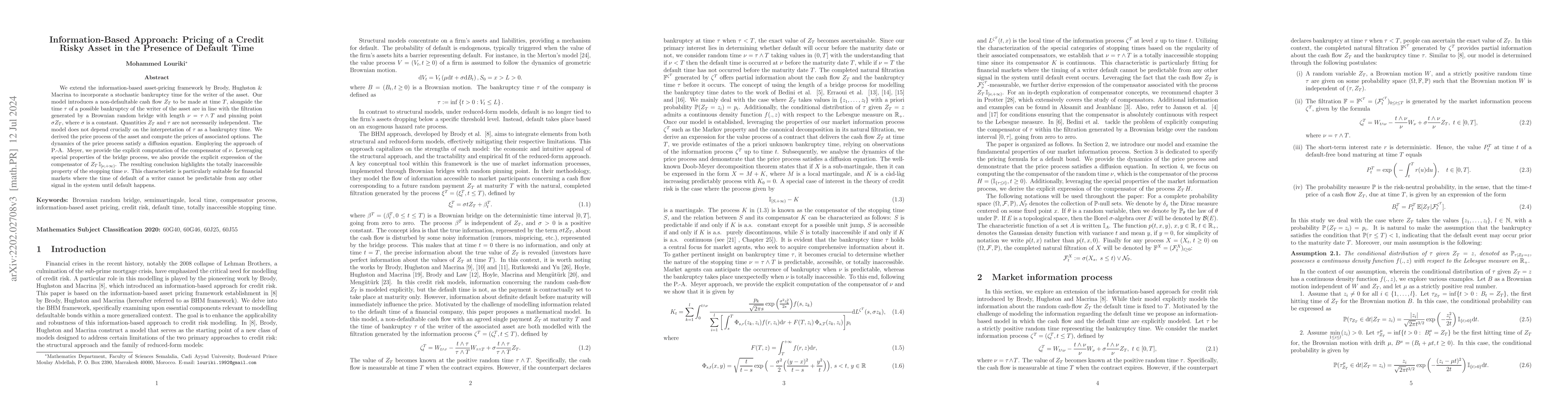

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)