Summary

Penalized likelihood methods with an $\ell_{\gamma}$-type penalty, such as the Bridge, the SCAD, and the MCP, allow us to estimate a parameter and to do variable selection, simultaneously, if $\gamma\in (0,1]$. In this method, it is important to choose a tuning parameter which controls the penalty level, since we can select the model as we want when we choose it arbitrarily. Nowadays, several information criteria have been developed to choose the tuning parameter without such an arbitrariness. However the bias correction term of such information criteria depend on the true parameter value in general, then we usually plug-in a consistent estimator of it to compute the information criteria from the data. In this paper, we derive a consistent estimator of the bias correction term of the AIC for the non-concave penalized likelihood method and propose a simple AIC-type information criterion for such models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

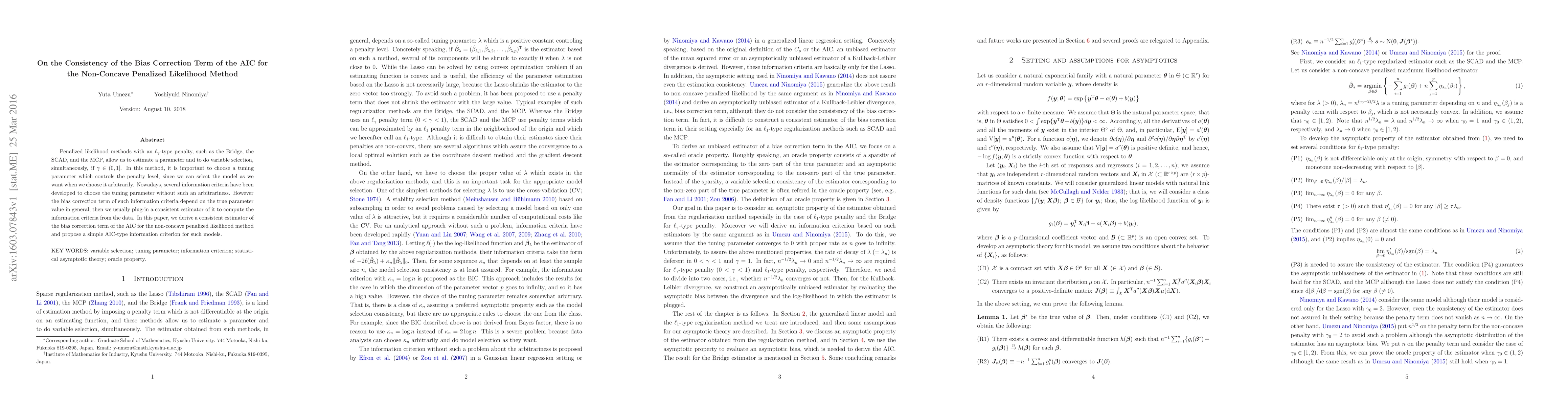

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)