Summary

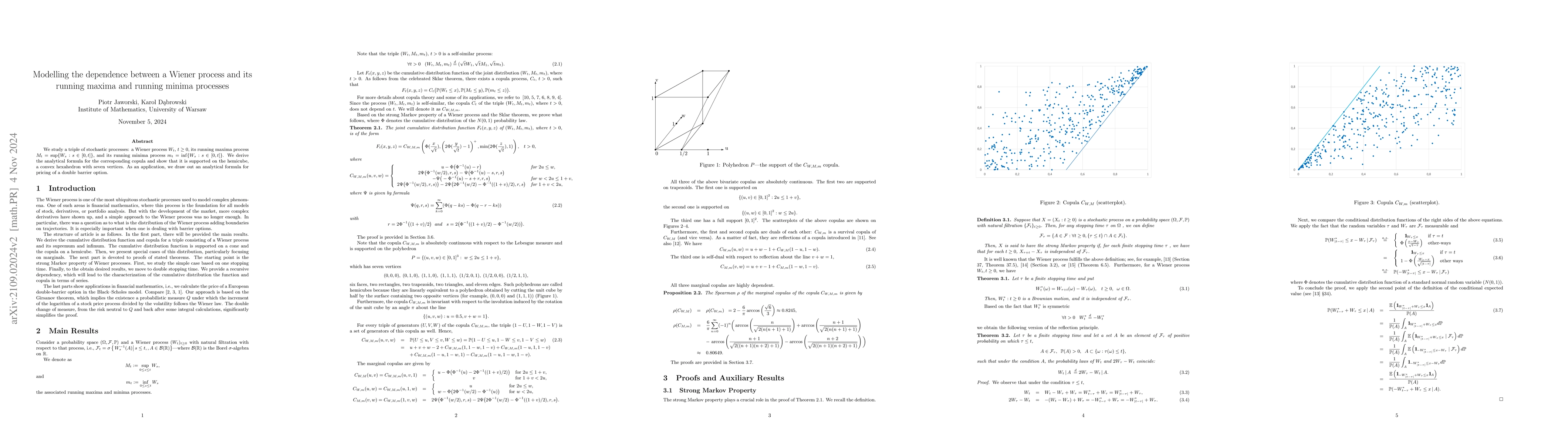

We study a triple of stochastic processes: a Wiener process $W_t$, $t \geq 0$, its running maxima process $M_t=\sup \{W_s: s \in [0,t]\}$ and its running minima process $m_t=\inf \{W_s: s \in [0,t]\}$. We derive the analytical formulas for the joint distribution function and the corresponding copula. As an application we draw out an analytical formula for pricing double barrier options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)