Summary

Securing an adequate supply of dispatchable resources is critical for keeping a power system reliable under high penetrations of variable generation. Traditional resource adequacy mechanisms are poorly suited to exploiting the growing flexibility and heterogeneity of load enabled by advancements in distributed resource and control technology. To address these challenges this paper develops a resource adequacy mechanism for the electricity sector utilising insurance risk management frameworks that is adapted to a future with variable generation and flexible demand. The proposed design introduces a central insurance scheme with prudential requirements that align diverse consumer reliability preferences with the financial objectives of an insurer-of-last-resort. We illustrate the benefits of the scheme in (i) differentiating load by usage to enable better management of the system during times of extreme scarcity, (ii) incentivising incremental investment in generation infrastructure that is aligned with consumer reliability preferences and (iii) improving overall reliability outcomes for consumers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

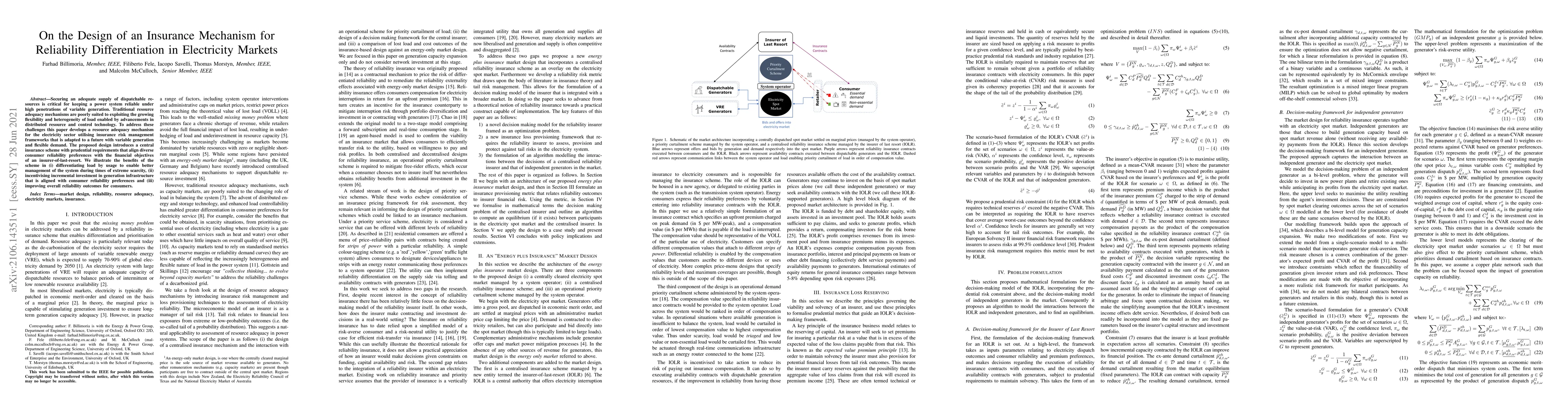

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIncentivizing Investment and Reliability: A Study on Electricity Capacity Markets

Cheng Guo, Christian Kroer, Daniel Bienstock et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)