Summary

We derive expressions for the finite-sample distribution of the Lasso estimator in the context of a linear regression model in low as well as in high dimensions by exploiting the structure of the optimization problem defining the estimator. In low dimensions, we assume full rank of the regressor matrix and present expressions for the cumulative distribution function as well as the densities of the absolutely continuous parts of the estimator. Our results are presented for the case of normally distributed errors, but do not hinge on this assumption and can easily be generalized. Additionally, we establish an explicit formula for the correspondence between the Lasso and the least-squares estimator. We derive analogous results for the distribution in less explicit form in high dimensions where we make no assumptions on the regressor matrix at all. In this setting, we also investigate the model selection properties of the Lasso and show that possibly only a subset of models might be selected by the estimator, completely independently of the observed response vector. Finally, we present a condition for uniqueness of the estimator that is necessary as well as sufficient.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

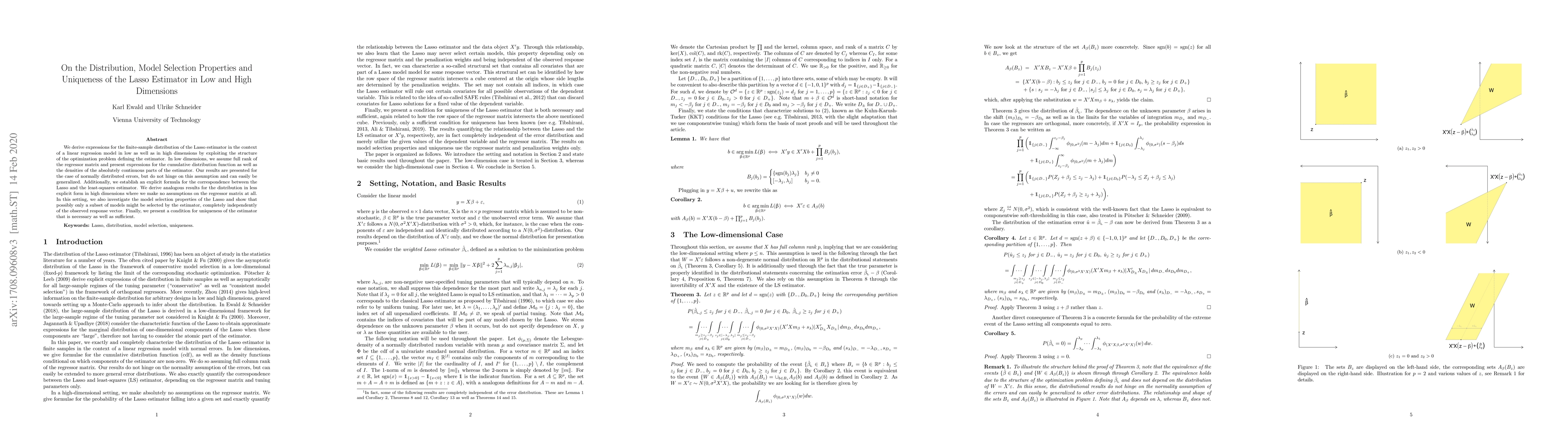

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)