Summary

In this paper, we study the dual problem of the expected utility maximization in incomplete markets with bounded random endowment. We start with the problem formulated in the paper of Cvitani\'{c}-Schachermayer-Wang (2001) and prove the following statement: in the Brownian framework, the countably additive part $Q^r$ of the dual optimizer $Q\in (L^\infty)^*$ obtained in that paper can be represented by the terminal value of a supermartingale deflator $Y$ defined in the paper of Kramkov-Schachermayer (1999), which is a local martingale.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

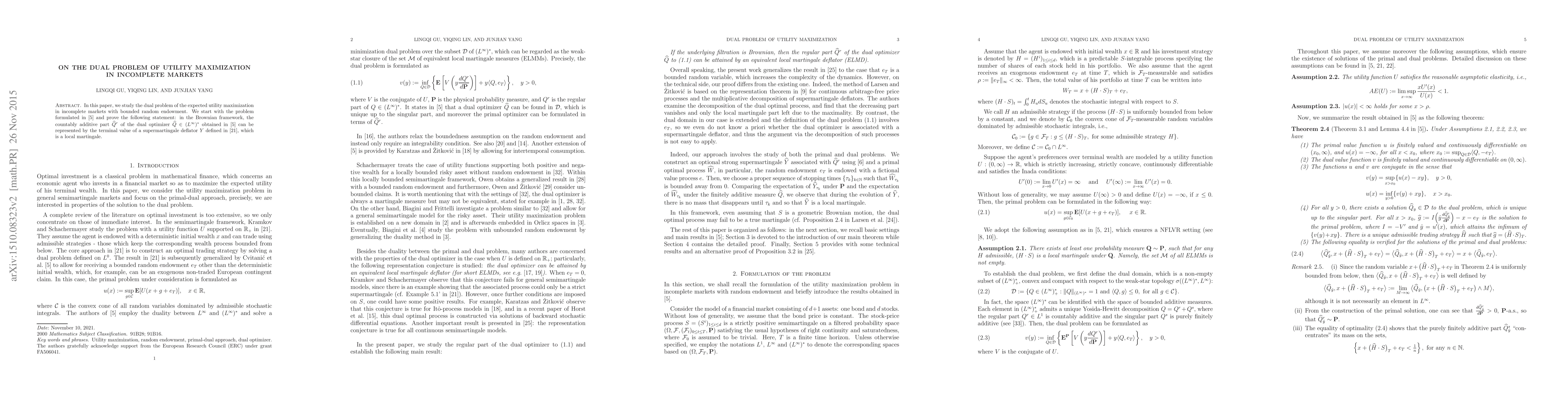

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)