Summary

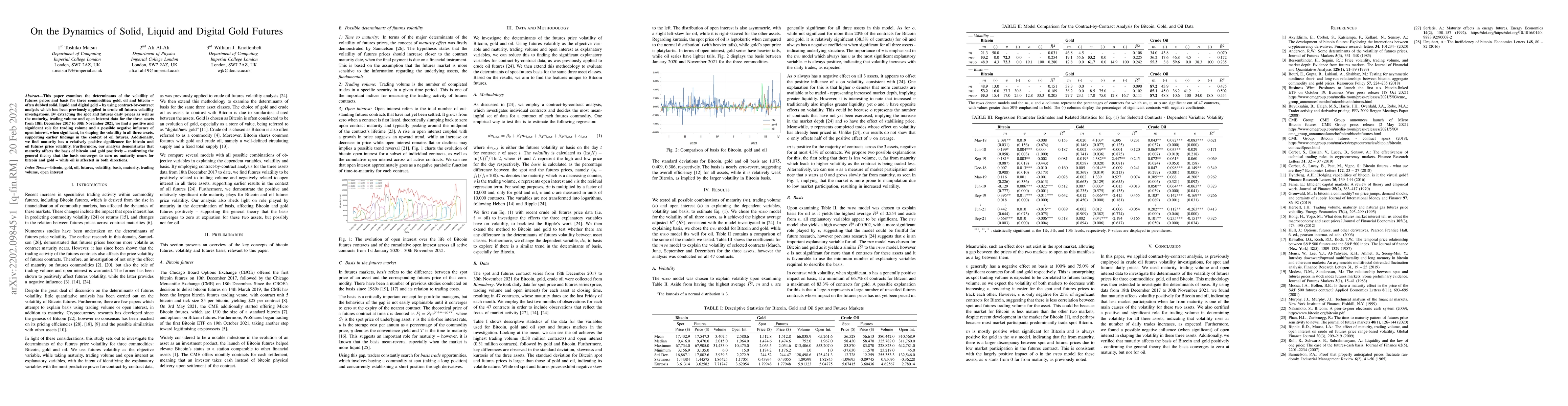

This paper examines the determinants of the volatility of futures prices and basis for three commodities: gold, oil and bitcoin -- often dubbed solid, liquid and digital gold -- by using contract-by-contract analysis which has been previously applied to crude oil futures volatility investigations. By extracting the spot and futures daily prices as well as the maturity, trading volume and open interest data for the three assets from 18th December 2017 to 30th November 2021, we find a positive and significant role for trading volume and a possible negative influence of open interest, when significant, in shaping the volatility in all three assets, supporting earlier findings in the context of oil futures. Additionally, we find maturity has a relatively positive significance for bitcoin and oil futures price volatility. Furthermore, our analysis demonstrates that maturity affects the basis of bitcoin and gold positively -- confirming the general theory that the basis converges to zero as maturity nears for bitcoin and gold -- while oil is affected in both directions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBreakup of viscous liquid bridges on solid surfaces

Peyman Rostami, Steffen Hardt, Salar Farokhi et al.

Advanced Digital Simulation for Financial Market Dynamics: A Case of Commodity Futures

Cheng Wang, Changjun Jiang, Chuwen Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)