Summary

We compute and discuss the Esscher martingale transform for exponential processes, the Esscher martingale transform for linear processes, the minimal martingale measure, the class of structure preserving martingale measures, and the minimum entropy martingale measure for stochastic volatility models of Ornstein-Uhlenbeck type as introduced by Barndorff-Nielsen and Shephard. We show, that in the model with leverage, with jumps both in the volatility and in the returns, all those measures are different, whereas in the model without leverage, with jumps in the volatility only and a continuous return process, several measures coincide, some simplifications can be made and the results are more explicit. We illustrate our results with parametric examples used in the literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

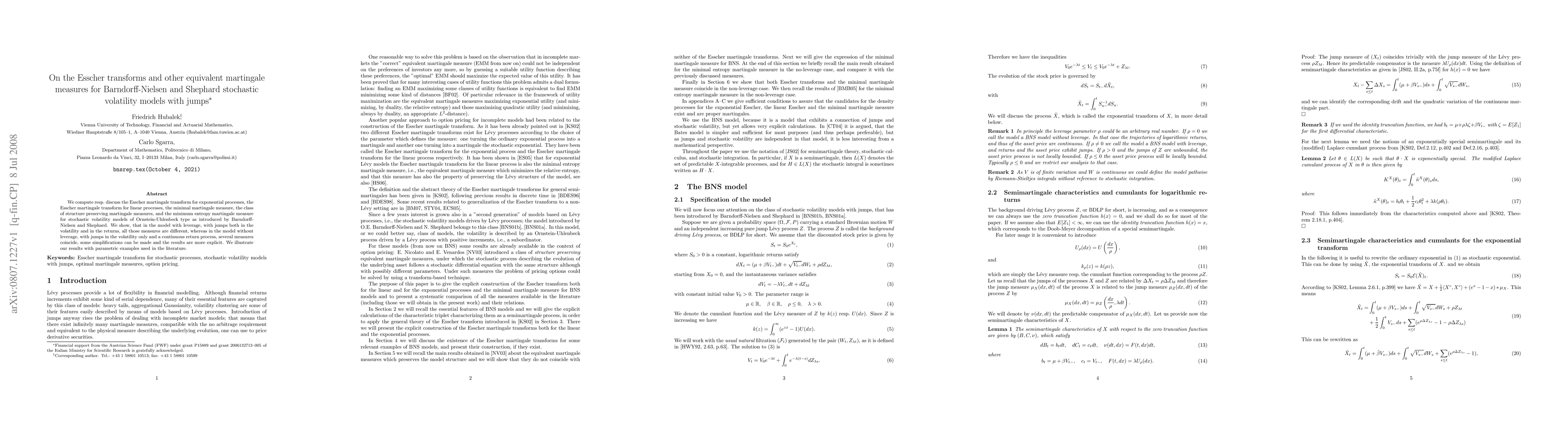

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)