Summary

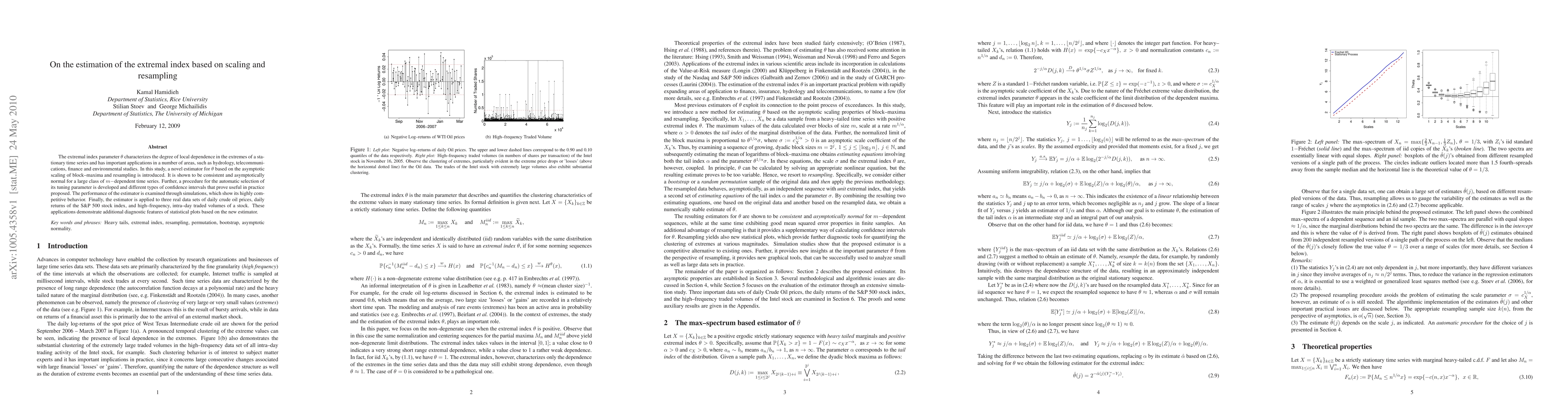

The extremal index parameter theta characterizes the degree of local dependence in the extremes of a stationary time series and has important applications in a number of areas, such as hydrology, telecommunications, finance and environmental studies. In this study, a novel estimator for theta based on the asymptotic scaling of block-maxima and resampling is introduced. It is shown to be consistent and asymptotically normal for a large class of m-dependent time series. Further, a procedure for the automatic selection of its tuning parameter is developed and different types of confidence intervals that prove useful in practice proposed. The performance of the estimator is examined through simulations, which show its highly competitive behavior. Finally, the estimator is applied to three real data sets of daily crude oil prices, daily returns of the S&P 500 stock index, and high-frequency, intra-day traded volumes of a stock. These applications demonstrate additional diagnostic features of statistical plots based on the new estimator.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)