Summary

It is often reported in forecast combination literature that a simple average of candidate forecasts is more robust than sophisticated combining methods. This phenomenon is usually referred to as the "forecast combination puzzle". Motivated by this puzzle, we explore its possible explanations including estimation error, invalid weighting formulas and model screening. We show that existing understanding of the puzzle should be complemented by the distinction of different forecast combination scenarios known as combining for adaptation and combining for improvement. Applying combining methods without consideration of the underlying scenario can itself cause the puzzle. Based on our new understandings, both simulations and real data evaluations are conducted to illustrate the causes of the puzzle. We further propose a multi-level AFTER strategy that can integrate the strengths of different combining methods and adapt intelligently to the underlying scenario. In particular, by treating the simple average as a candidate forecast, the proposed strategy is shown to avoid the heavy cost of estimation error and, to a large extent, solve the forecast combination puzzle.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

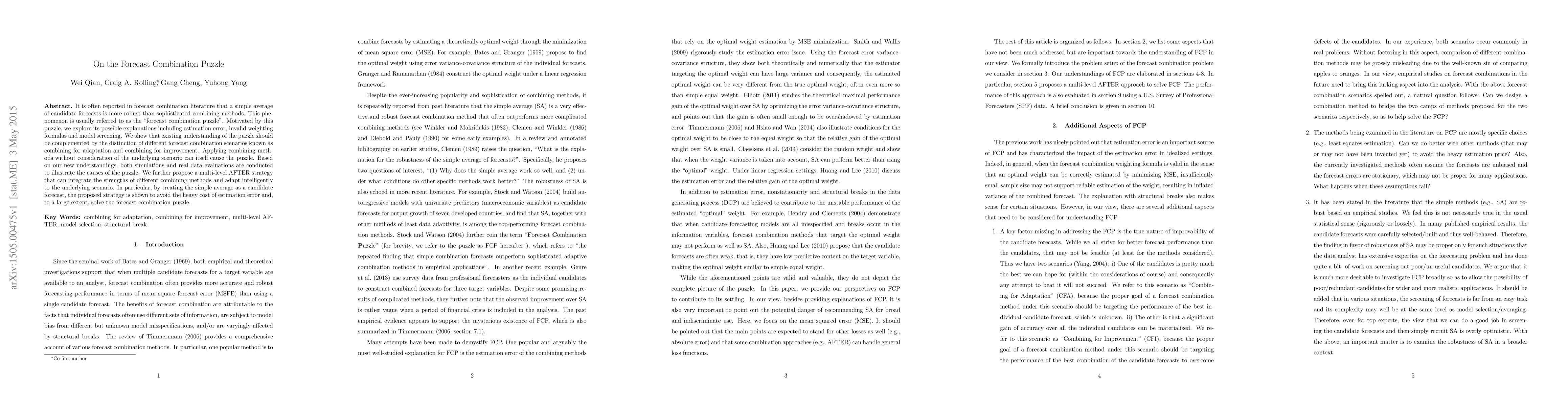

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSolving the Forecast Combination Puzzle

David T. Frazier, Gael M. Martin, Ryan Covey et al.

Bayesian forecast combination using time-varying features

Li Li, Feng Li, Yanfei Kang

| Title | Authors | Year | Actions |

|---|

Comments (0)