Summary

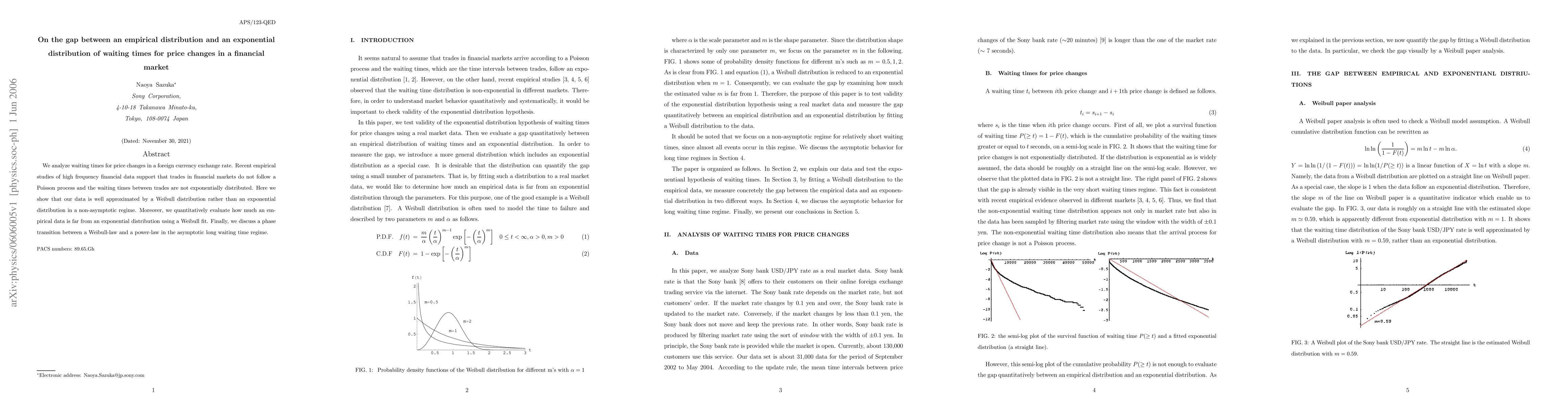

We analyze waiting times for price changes in a foreign currency exchange rate. Recent empirical studies of high frequency financial data support that trades in financial markets do not follow a Poisson process and the waiting times between trades are not exponentially distributed. Here we show that our data is well approximated by a Weibull distribution rather than an exponential distribution in a non-asymptotic regime. Moreover, we quantitatively evaluate how much an empirical data is far from an exponential distribution using a Weibull fit. Finally, we discuss a phase transition between a Weibull-law and a power-law in the asymptotic long waiting time regime.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)