Summary

Recent spectrum auctions in the United Kingdom, and some proposals for future auctions of spectrum in the United States, are based on preliminary price discovery rounds, followed by calculation of final prices for the winning buyers. For example, the prices could be the projection of Vikrey prices onto the core of reported prices. The use of Vikrey prices should lead to more straightforward bidding, but the projection reverses some of the incentive for bidders to report truthfully. Still, we conjecture that the price paid by a winning buyer increases no faster than the bid, as in a first price auction. It would be rather disturbing if the conjecture is false. The conjecture is established for a buyer interacting with disjoint groups of other buyers in a star network setting. It is also shown that for any core-selecting payment rule and any integer w greater than or equal to two, there is a market setting with w winning buyers such that the price paid by some winning buyer increases at least (1-1/w) times as fast as the price bid.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

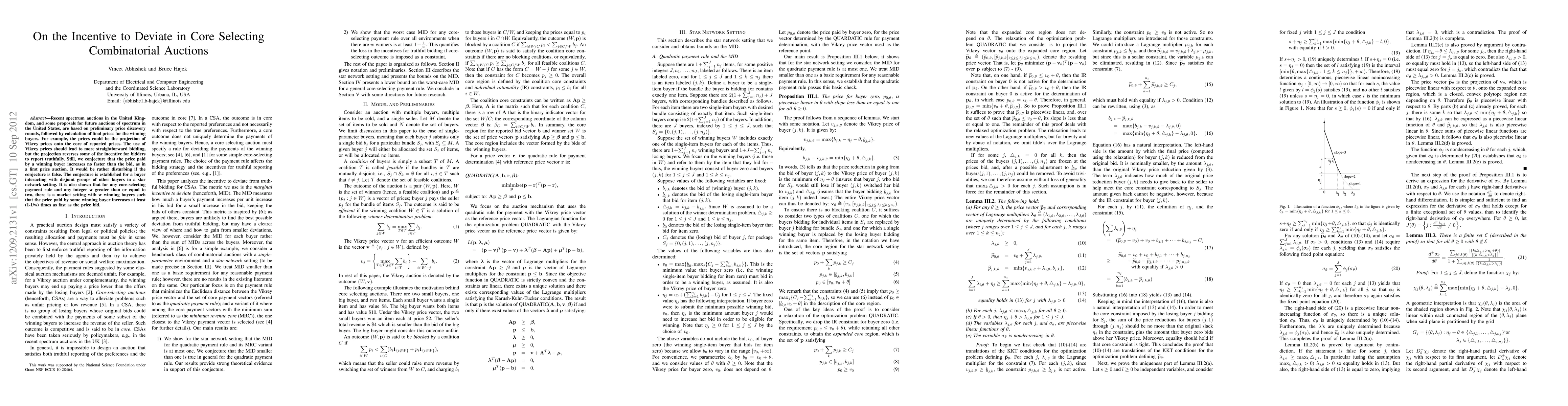

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWeakest Bidder Types and New Core-Selecting Combinatorial Auctions

Tuomas Sandholm, Maria-Florina Balcan, Siddharth Prasad

Understanding the Relationship Between Core Constraints and Core-Selecting Payment Rules in Combinatorial Auctions

Ye Wang, Roger Wattenhofer, Robin Fritsch et al.

Exploring Leximin Principle for Fair Core-Selecting Combinatorial Auctions: Payment Rule Design and Implementation

Hao Cheng, Bo An, Yanchen Deng et al.

Efficient Core-selecting Incentive Mechanism for Data Sharing in Federated Learning

Mingqiang Li, Mengda Ji, Genjiu Xu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)