Summary

Demographic changes increase the necessity to base the pension system more and more on the second and the third pillar, namely the occupational and private pension plans; this paper deals with Target Date Funds (TDFs), which are a typical investment opportunity for occupational pension planners. TDFs are usually identified with a decreasing fraction of wealth invested in equity (a so-called glide path) as retirement comes closer, i.e., wealth is invested more risky the younger the saver is. We investigate whether this is actually optimal in the presence of non-tradable income risk in a stochastic volatility environment. The retirement planning procedure is formulated as a stochastic optimization problem. We find it is the (random) contributions that induce the optimal path exhibiting a glide path structure, both in the constant and stochastic volatility environment. Moreover, the initial wealth and the initial contribution made to a retirement account strongly influence the fractional amount of wealth to be invested in risky assets. The risk aversion of an individual mainly determines the steepness of the glide path.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

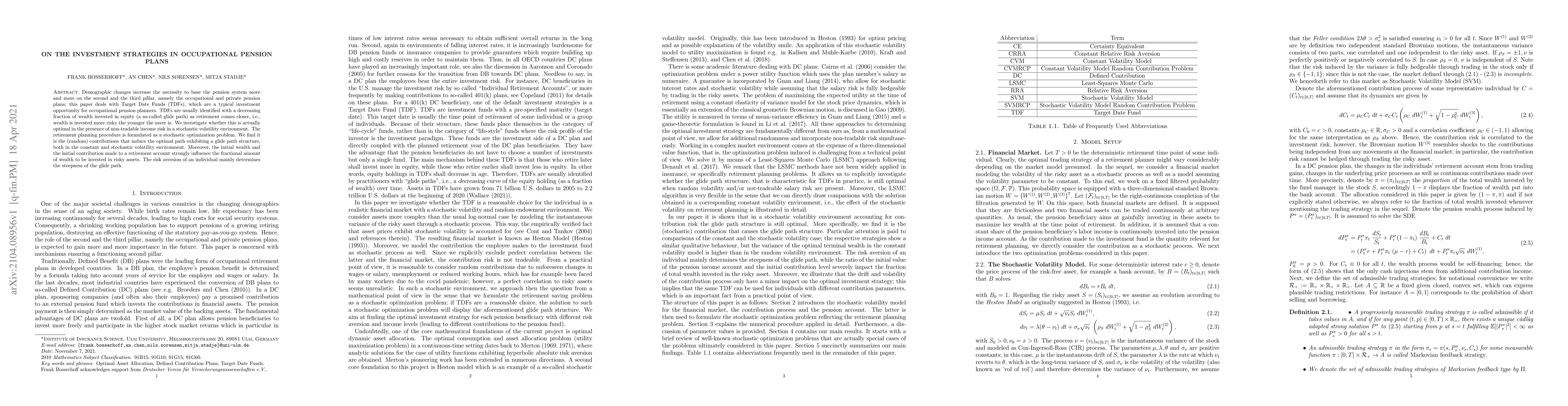

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)