Summary

This paper studies the market viability with proportional transaction costs. Instead of requiring the existence of strictly consistent price systems (SCPS) as in the literature, we show that strictly consistent local martingale systems (SCLMS) can successfully serve as the dual elements such that the market viability can be verified. We introduce two weaker notions of no arbitrage conditions on market models named no unbounded profit with bounded risk (NUPBR) and no local arbitrage with bounded portfolios (NLABP). In particular, we show that the NUPBR and NLABP conditions in the robust sense for the smaller bid-ask spreads is the equivalent characterization of the existence of SCLMS for general market models. We also discuss the implications for the utility maximization problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

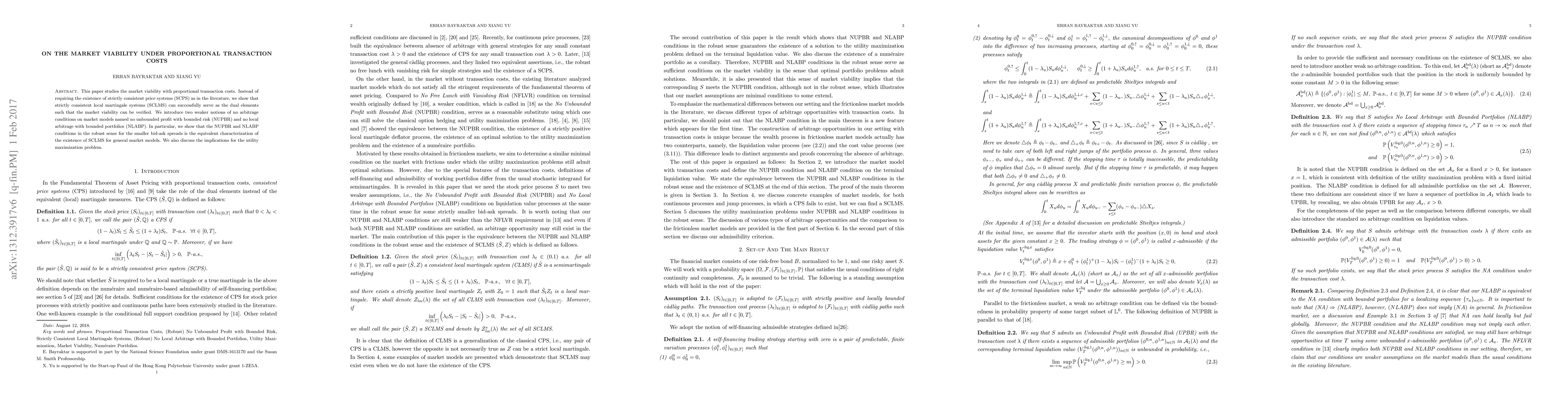

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)