Summary

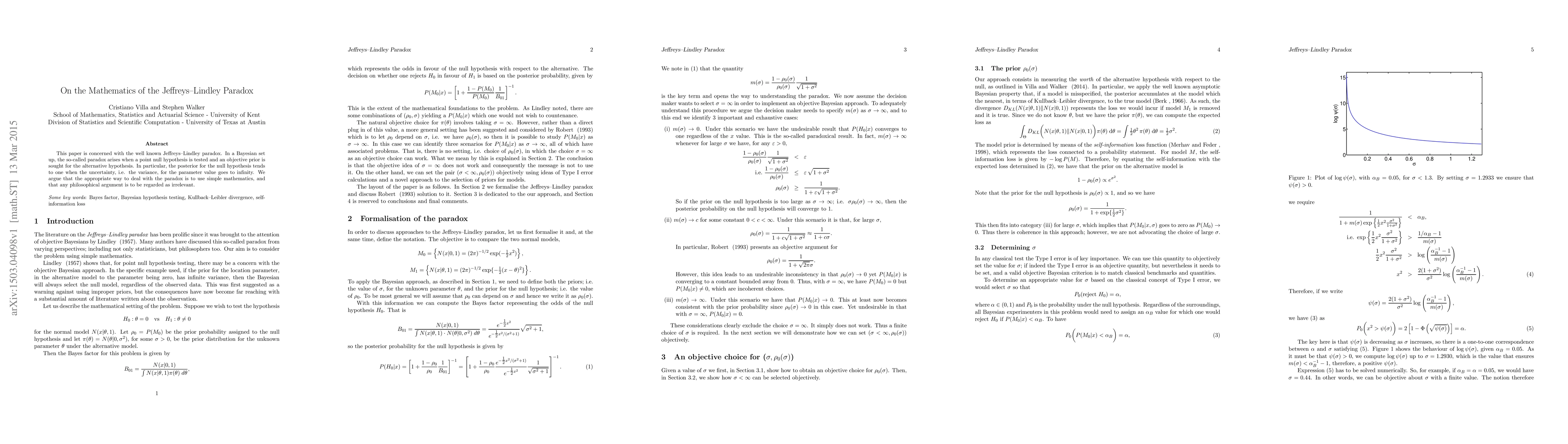

This paper is concerned with the well known Jeffreys-Lindley paradox. In a Bayesian set up, the so-called paradox arises when a point null hypothesis is tested and an objective prior is sought for the alternative hypothesis. In particular, the posterior for the null hypothesis tends to one when the uncertainty, i.e. the variance, for the parameter value goes to infinity. We argue that the appropriate way to deal with the paradox is to use simple mathematics, and that any philosophical argument is to be regarded as irrelevant.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHistory and Nature of the Jeffreys-Lindley Paradox

Eric-Jan Wagenmakers, Alexander Ly

| Title | Authors | Year | Actions |

|---|

Comments (0)