Summary

In this paper, we study a stochastic optimal control problem with stochastic volatility. We prove the sufficient and necessary maximum principle for the proposed problem. Then we apply the results to solve an investment, consumption and life insurance problem with stochastic volatility, that is, we consider a wage earner investing in one risk-free asset and one risky asset described by a jump-diffusion process and has to decide concerning consumption and life insurance purchase. We assume that the life insurance for the wage earner is bought from a market composed of $M>1$ life insurance companies offering pairwise distinct life insurance contracts. The goal is to maximize the expected utilities derived from the consumption, the legacy in the case of a premature death and the investor's terminal wealth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

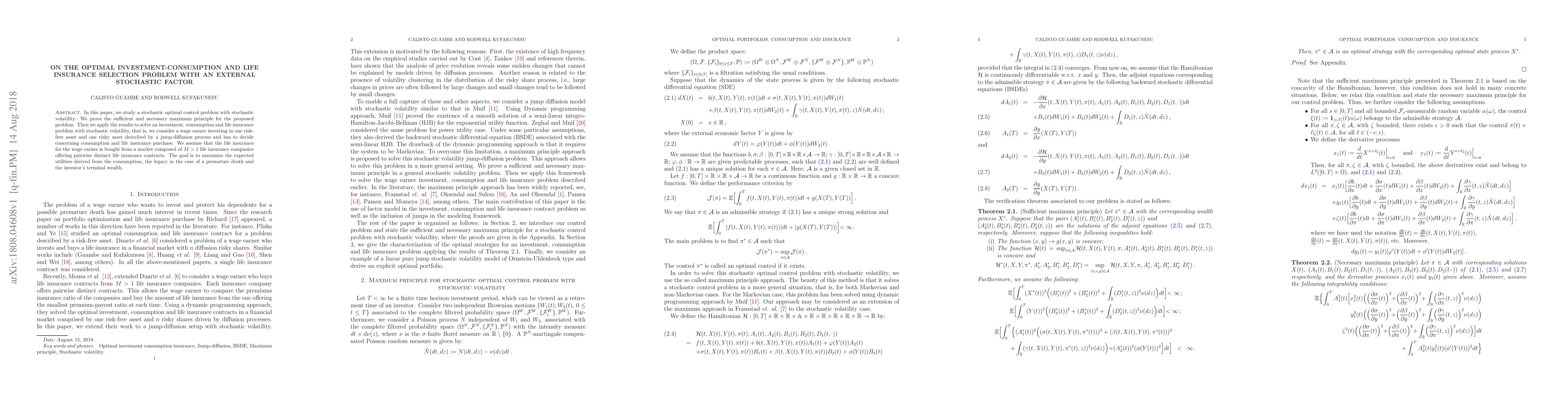

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal investment-consumption and life insurance selection problem under inflation. A BSDE approach

Optimal investment, consumption and life insurance decisions for households with consumption habits under the health shock risk

Zhen Zhao, Wei Liu, Xiaoyi Tang

No citations found for this paper.

Comments (0)