Summary

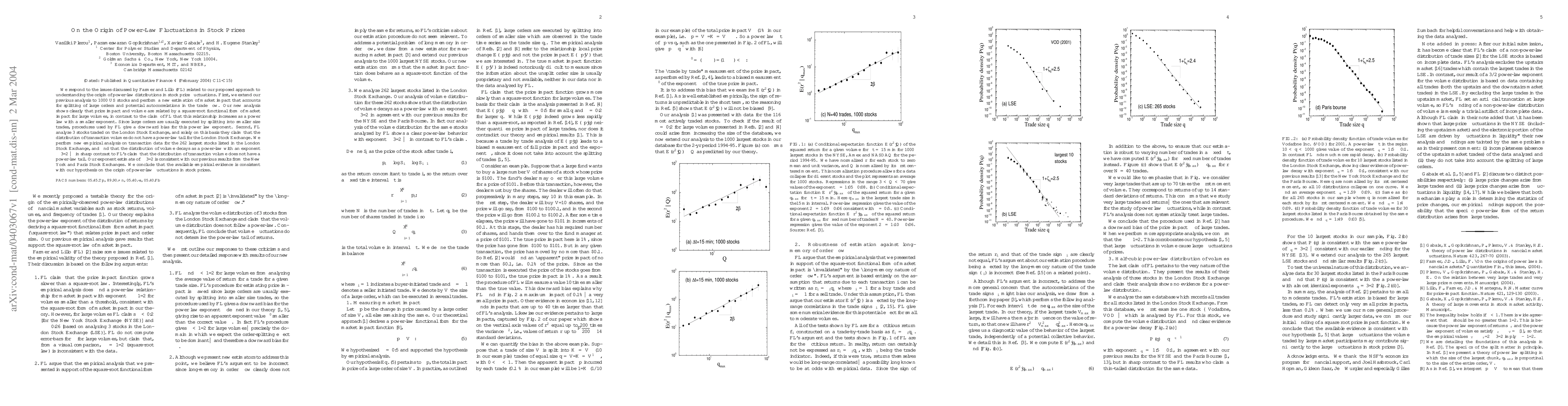

We respond to the issues discussed by Farmer and Lillo (FL) related to our proposed approach to understanding the origin of power-law distributions in stock price fluctuations. First, we extend our previous analysis to 1000 US stocks and perform a new estimation of market impact that accounts for splitting of large orders and potential autocorrelations in the trade flow. Our new analysis shows clearly that price impact and volume are related by a square-root functional form of market impact for large volumes, in contrast to the claim of FL that this relationship increases as a power law with a smaller exponent. Since large orders are usually executed by splitting into smaller size trades, procedures used by FL give a downward bias for this power law exponent. Second, FL analyze 3 stocks traded on the London Stock Exchange, and solely on this basis they claim that the distribution of transaction volumes do not have a power-law tail for the London Stock Exchange. We perform new empirical analysis on transaction data for the 262 largest stocks listed in the London Stock Exchange, and find that the distribution of volume decays as a power-law with an exponent $\approx 3/2$ -- in sharp contrast to FL's claim that the distribution of transaction volume does not have a power-law tail. Our exponent estimate of $\approx 3/2$ is consistent with our previous results from the New York and Paris Stock Exchanges. We conclude that the available empirical evidence is consistent with our hypothesis on the origin of power-law fluctuations in stock prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)