Authors

Summary

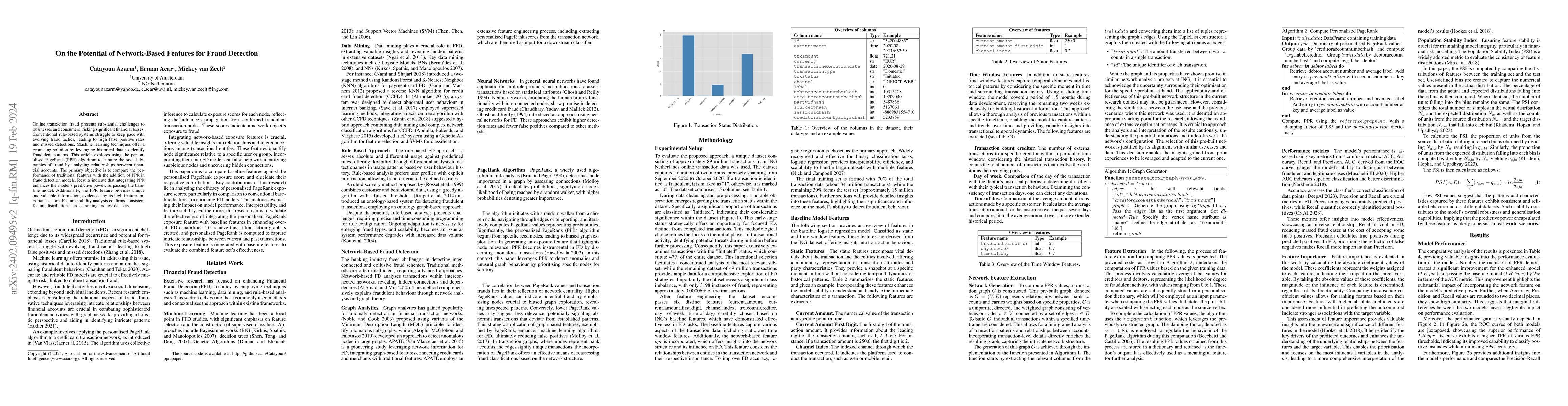

Online transaction fraud presents substantial challenges to businesses and consumers, risking significant financial losses. Conventional rule-based systems struggle to keep pace with evolving fraud tactics, leading to high false positive rates and missed detections. Machine learning techniques offer a promising solution by leveraging historical data to identify fraudulent patterns. This article explores using the personalised PageRank (PPR) algorithm to capture the social dynamics of fraud by analysing relationships between financial accounts. The primary objective is to compare the performance of traditional features with the addition of PPR in fraud detection models. Results indicate that integrating PPR enhances the model's predictive power, surpassing the baseline model. Additionally, the PPR feature provides unique and valuable information, evidenced by its high feature importance score. Feature stability analysis confirms consistent feature distributions across training and test datasets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImproving Fraud Detection via Hierarchical Attention-based Graph Neural Network

Yajing Liu, Wensheng Zhang, Zhengya Sun

| Title | Authors | Year | Actions |

|---|

Comments (0)