Summary

We study the power and limits of optimal dynamic pricing in combinatorial markets; i.e., dynamic pricing that leads to optimal social welfare. Previous work by Cohen-Addad et al. [EC'16] demonstrated the existence of optimal dynamic prices for unit-demand buyers, and showed a market with coverage valuations that admits no such prices. However, finding the frontier of markets (i.e., valuation functions) that admit optimal dynamic prices remains an open problem. In this work we establish positive and negative results that narrow the existing gap. On the positive side, we provide tools for handling markets beyond unit-demand valuations. In particular, we characterize all optimal allocations in multi-demand markets. This characterization allows us to partition the items into equivalence classes according to the role they play in achieving optimality. Using these tools, we provide a poly-time optimal dynamic pricing algorithm for up to $3$ multi-demand buyers. On the negative side, we establish a maximal domain theorem, showing that for every non-gross substitutes valuation, there exist unit-demand valuations such that adding them yields a market that does not admit an optimal dynamic pricing. This result is the dynamic pricing equivalent of the seminal maximal domain theorem by Gul and Stacchetti [JET'99] for Walrasian equilibrium. Yang [JET'17] discovered an error in their original proof, and established a different, incomparable version of their maximal domain theorem. En route to our maximal domain theorem for optimal dynamic pricing, we provide the first complete proof of the original theorem by Gul and Stacchetti.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

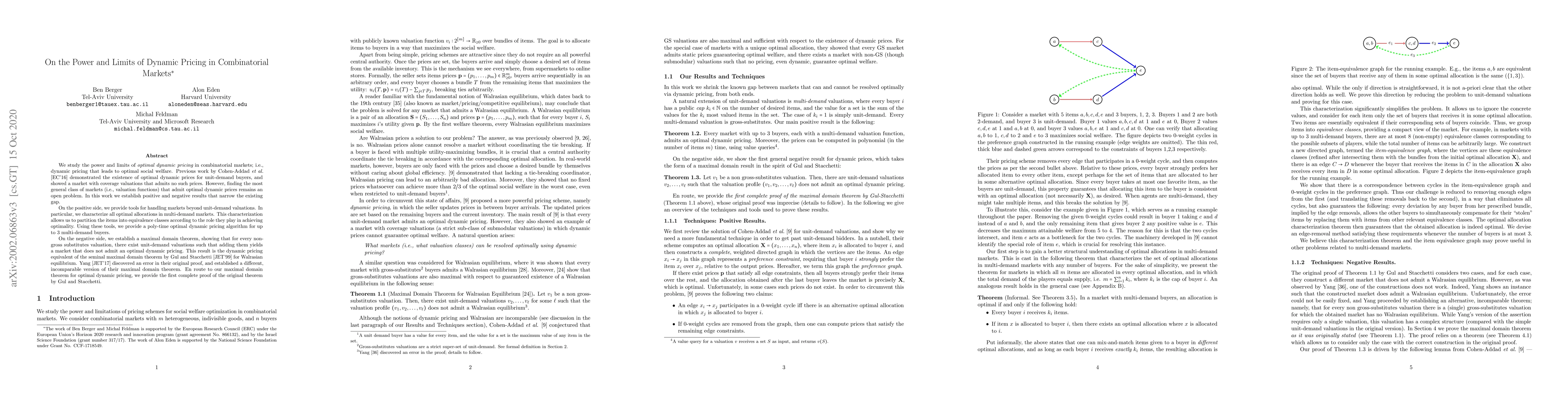

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA dual approach for dynamic pricing in multi-demand markets

Kristóf Bérczi, Erika R. Bérczi-Kovács, Evelin Szögi

A Two-Step Approach to Optimal Dynamic Pricing in Multi-Demand Combinatorial Markets

Kanstantsin Pashkovich, Xinyue Xie

Analysis of Wind Power Integration in Electricity Markets LMP Pricing

Amin Ahmadi Kasani, Narin Nemati

| Title | Authors | Year | Actions |

|---|

Comments (0)