Summary

We study the regularity of the stochastic representation of the solution of a class of initial-boundary value problems related to a regime-switching diffusion. This representation is related to the value function of a finite-horizon optimal stopping problem such as the price of an American-style option in finance. We show continuity and smoothness of the value function using coupling and time-change techniques. As an application, we find the minimal payoff scenario for the holder of an American-style option in the presence of regime-switching uncertainty under the assumption that the transition rates are known to lie within level-dependent compact sets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

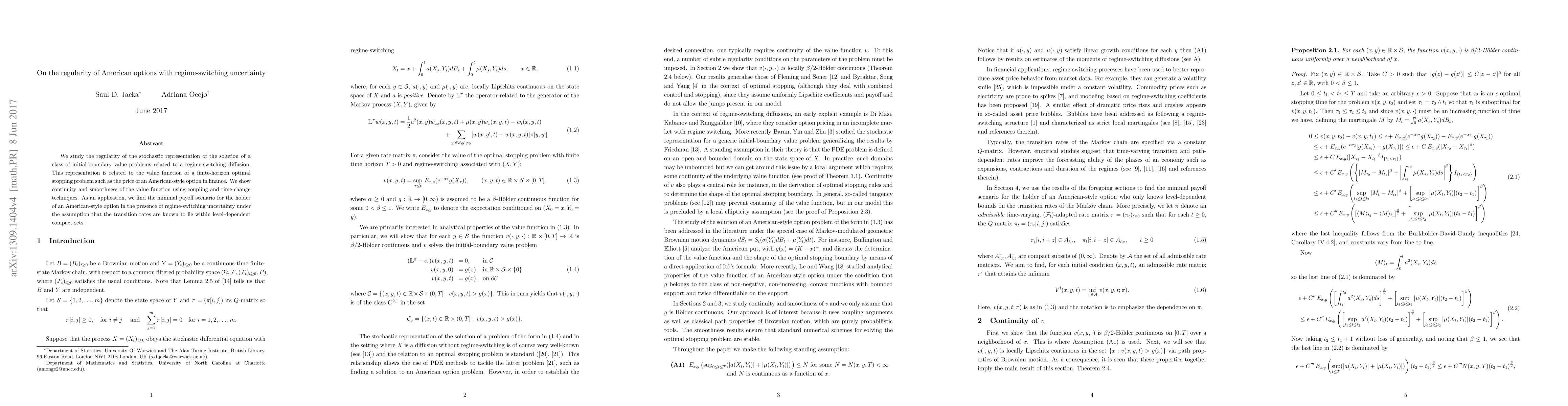

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExplicit RKF-Compact Scheme for Pricing Regime Switching American Options with Varying Time Step

Weizhong Dai, Chinonso Nwankwo

| Title | Authors | Year | Actions |

|---|

Comments (0)