Summary

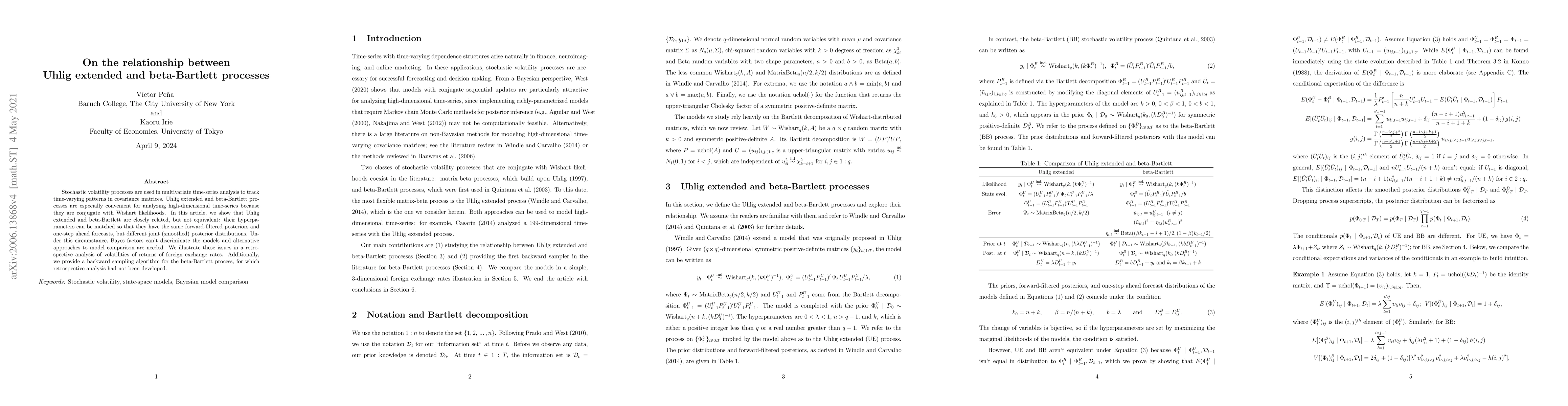

Stochastic volatility processes are used in multivariate time-series analysis to track time-varying patterns in covariance matrices. Uhlig extended and beta-Bartlett processes are especially convenient for analyzing high-dimensional time-series because they are conjugate with Wishart likelihoods. In this article, we show that Uhlig extended and beta-Bartlett are closely related, but not equivalent: their hyperparameters can be matched so that they have the same forward-filtered posteriors and one-step ahead forecasts, but different joint (smoothed) posterior distributions. Under this circumstance, Bayes factors can't discriminate the models and alternative approaches to model comparison are needed. We illustrate these issues in a retrospective analysis of volatilities of returns of foreign exchange rates. Additionally, we provide a backward sampling algorithm for the beta-Bartlett process, for which retrospective analysis had not been developed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)