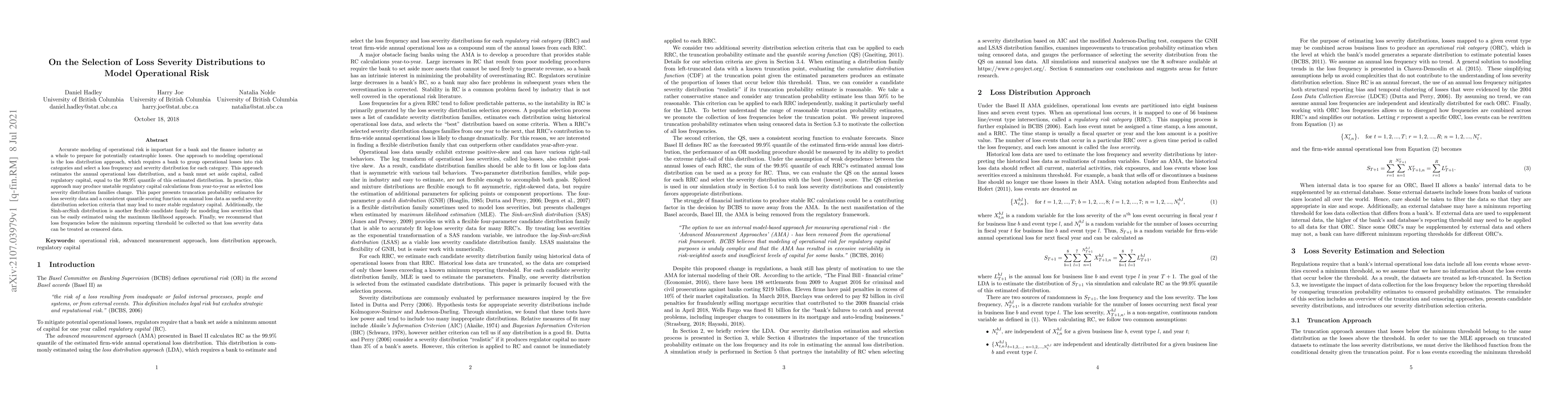

Summary

Accurate modeling of operational risk is important for a bank and the finance industry as a whole to prepare for potentially catastrophic losses. One approach to modeling operational is the loss distribution approach, which requires a bank to group operational losses into risk categories and select a loss frequency and severity distribution for each category. This approach estimates the annual operational loss distribution, and a bank must set aside capital, called regulatory capital, equal to the 0.999 quantile of this estimated distribution. In practice, this approach may produce unstable regulatory capital calculations from year-to-year as selected loss severity distribution families change. This paper presents truncation probability estimates for loss severity data and a consistent quantile scoring function on annual loss data as useful severity distribution selection criteria that may lead to more stable regulatory capital. Additionally, the Sinh-arcSinh distribution is another flexible candidate family for modeling loss severities that can be easily estimated using the maximum likelihood approach. Finally, we recommend that loss frequencies below the minimum reporting threshold be collected so that loss severity data can be treated as censored data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSemi-nonparametric Estimation of Operational Risk Capital with Extreme Loss Events

Heng Z. Chen, Stephen R. Cosslett

Estimating the correlation between operational risk loss categories over different time horizons

Maurice L. Brown, Cheng Ly

No citations found for this paper.

Comments (0)