Summary

This paper provides a new version of the condition of Di Nunno et al. (2003), Ankirchner and Imkeller (2005) and Biagini and \{O}ksendal (2005) ensuring the semimartingale property for a large class of continuous stochastic processes. Unlike our predecessors, we base our modeling framework on the concept of portfolio proportions which yields a short self-contained proof of the main theorem, as well as a counterexample, showing that analogues of our results do not hold in the discontinuous setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

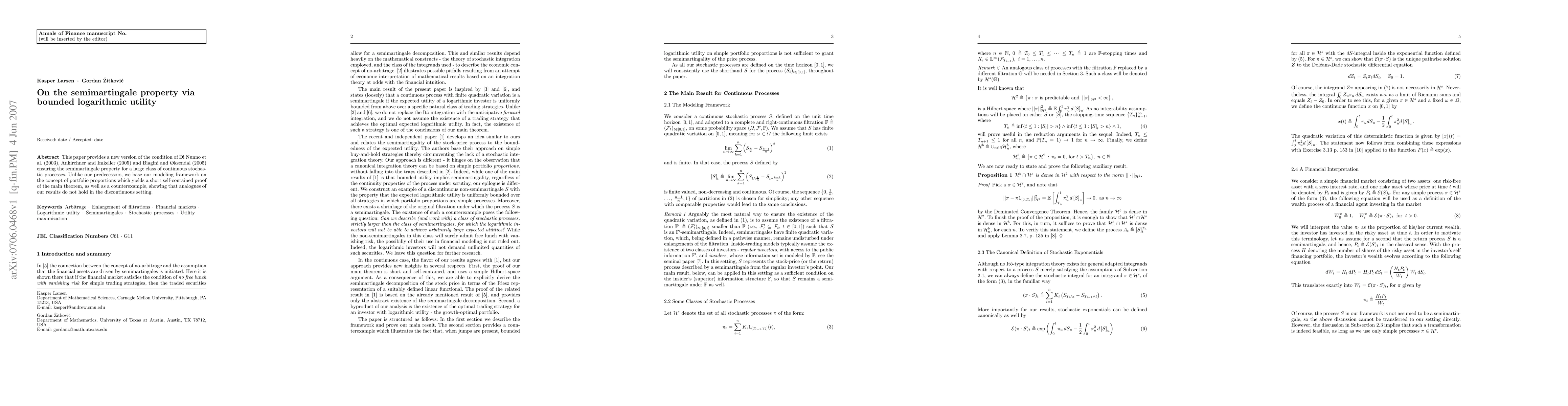

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)