Summary

A typical approach to tackle stochastic control problems with partial observation is to separate the control and estimation tasks. However, it is well known that this separation generally fails to deliver an actual optimal solution for risk-sensitive control problems. This paper investigates the separability of a general class of risk-sensitive investment management problems when a finite-dimensional filter exists. We show that the corresponding separated problem, where instead of the unobserved quantities, one considers their conditional filter distribution given the observations, is strictly equivalent to the original control problem. We widen the applicability of the so-called Modified Zakai Equation (MZE) for the study of the separated problem and prove that the MZE simplifies to a PDE in our approach. Furthermore, we derive criteria for separability. We do not solve the separated control problem but note that the existence of a finite-dimensional filter leads to a finite state space for the separated problem. Hence, the difficulty is equivalent to solving a complete observation risk-sensitive problem. Our results have implications for existing risk-sensitive investment management models with partial observations in that they establish their separability. Their implications for future research on new applications is mainly to provide conditions to ensure separability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

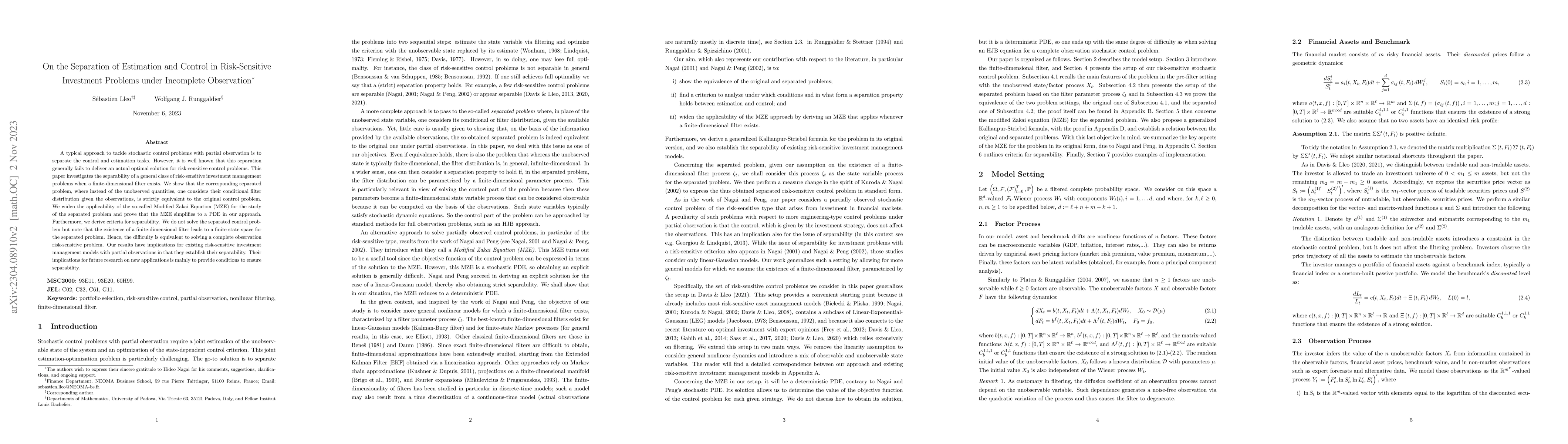

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)