Summary

In commodity markets the convergence of futures towards spot prices, at the expiration of the contract, is usually justified by no-arbitrage arguments. In this article, we propose an alternative approach that relies on the expected profit maximization problem of an agent, producing and storing a commodity while trading in the associated futures contracts. In this framework, the relation between the spot and the futures prices holds through the well-posedness of the maximization problem. We show that the futures price can still be seen as the risk-neutral expectation of the spot price at maturity and we propose an explicit formula for the forward volatility. Moreover, we provide an heuristic analysis of the optimal solution for the production/storage/trading problem, in a Markovian setting. This approach is particularly interesting in the case of energy commodities, like electricity: this framework indeed remains suitable for commodities characterized by storability constraints, when standard no-arbitrage arguments cannot be safely applied.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

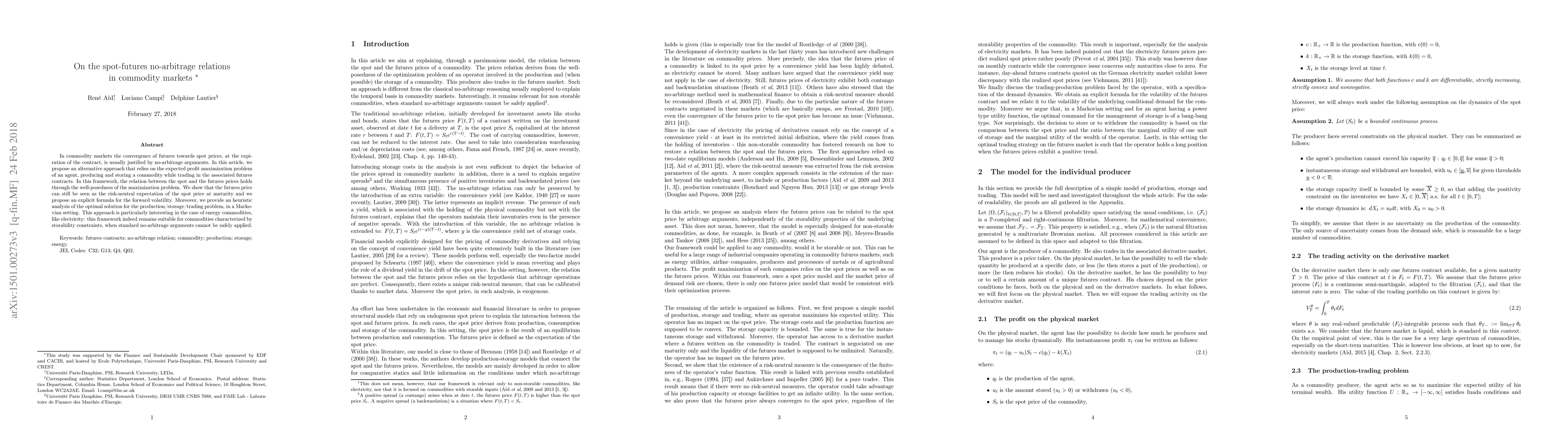

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInterpolating commodity futures prices with Kriging

Andrea Pallavicini, Andrea Maran

A hidden Markov model for statistical arbitrage in international crude oil futures markets

Claudio Fontana, Viviana Fanelli, Francesco Rotondi

| Title | Authors | Year | Actions |

|---|

Comments (0)