Summary

High shares of variable renewable energy necessitate substantial energy storage capacity. However, it remains unclear how to design a market that, on the one hand, ensures a stable and sufficient income for storage firms, and, on the other hand, maintains stable and affordable electricity costs for the consumers. Here, we use a game theoretic model to study storage competition in wholesale electricity markets. A main result is that these types of games are not necessarily stable. In particular, we find that under certain conditions, which imply a combination of a high share of variable renewable energy sources and low flexibility of conventional power plants, the system will not converge to an equilibrium. However, we demonstrate that a price cap on storage price bids can ensure convergence to a stable solution. Moreover, we find that when the flexibility of conventional power plants is low, while the storage usage for energy balancing increases with renewable energy generation, the profitability of using storage for the sole purpose of energy arbitrage decreases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

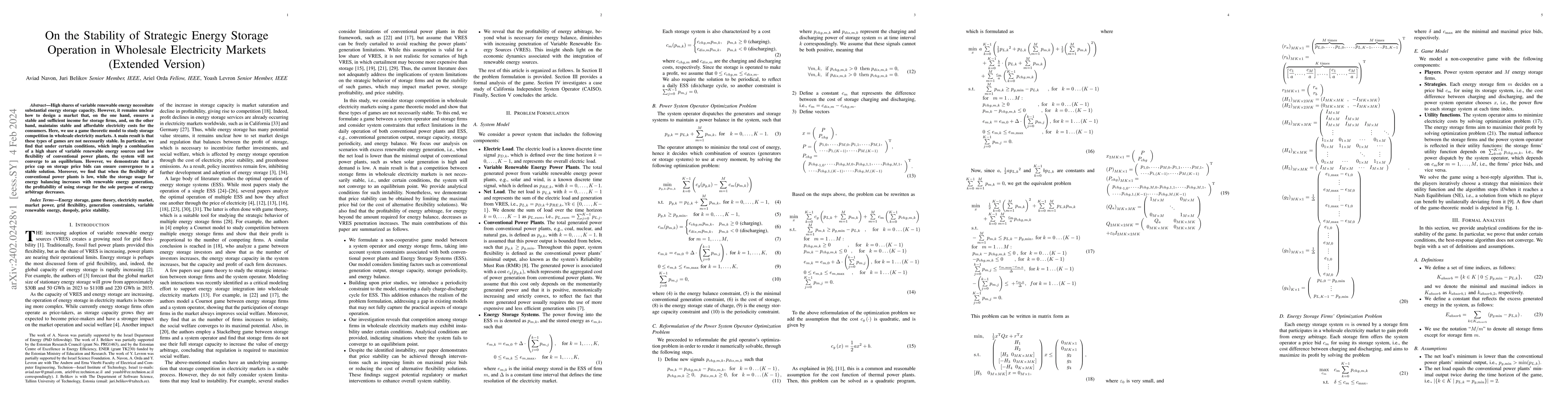

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStrategic Storage Investment in Electricity Markets

Audun Botterud, Mehdi Jafari, Dongwei Zhao et al.

Strategic Investments of Large Scale Battery Energy Storage Systems in the Wholesale Electricity Market

Ang Li, Lei Fan, Yubo Wang et al.

Correlations and Clustering in Wholesale Electricity Markets

Francesco Caravelli, Tianyu Cui, Cozmin Ududec

No citations found for this paper.

Comments (0)