Summary

Nonlinear panel data models with fixed individual effects provide an important set of tools for describing microeconometric data. In a large class of such models (including probit, proportional hazard and quantile regression to name just a few) it is impossible to difference out individual effects, and inference is usually justified in a `large n large T' asymptotic framework. However, there is a considerable gap in the type of assumptions that are currently imposed in models with smooth score functions (such as probit, and proportional hazard) and quantile regression. In the present paper we show that this gap can be bridged and establish asymptotic unbiased normality for quantile regression panels under conditions on n,T that are very close to what is typically assumed in standard nonlinear panels. Our results considerably improve upon existing theory and show that quantile regression is applicable to the same type of panel data (in terms of n,T) as other commonly used nonlinear panel data models. Thorough numerical experiments confirm our theoretical findings.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

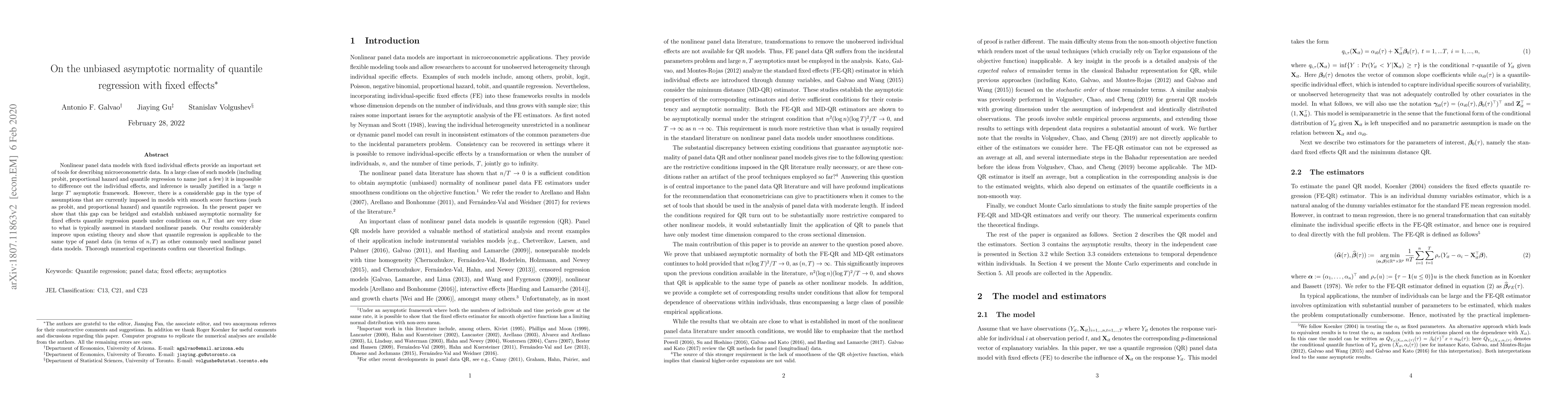

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUnconditional Quantile Partial Effects via Conditional Quantile Regression

Julian Martinez-Iriarte, Javier Alejo, Antonio F. Galvao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)