Authors

Summary

We study the Bayesian coarse correlated equilibrium (BCCE) of continuous and discretised first-price and all-pay auctions under the standard symmetric independent private-values model. Our goal is to determine how the canonical Bayes-Nash equilibrium (BNE) of the auction relates to the outcome when all buyers bid following no-regret algorithms. Numerical experiments show that in two buyer first-price auctions the Wasserstein-$2$ distance of buyers' marginal bid distributions decline as $O(1/n)$ in the discretisation size in instances where the prior distribution is concave, whereas all-pay auctions exhibit similar behaviour without prior dependence. To explain this convergence to a near-equilibrium, we study uniqueness of the BCCE of the continuous auction. Our uniqueness results translate to provable convergence of deterministic self-play to a near equilibrium outcome in these auctions. In the all-pay auction, we show that independent of the prior distribution there is a unique BCCE with symmetric, differentiable, and increasing bidding strategies, which is equivalent to the unique strict BNE. In the first-price auction, we need stronger conditions. Either the prior is strictly concave or the learning algorithm has to be restricted to strictly increasing strategies. Without such strong assumptions, no-regret algorithms can end up in low-price pooling strategies. This is important because it proves that in repeated first-price auctions such as in display ad actions, algorithmic collusion cannot be ruled out without further assumptions even if all bidders rely on no-regret algorithms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

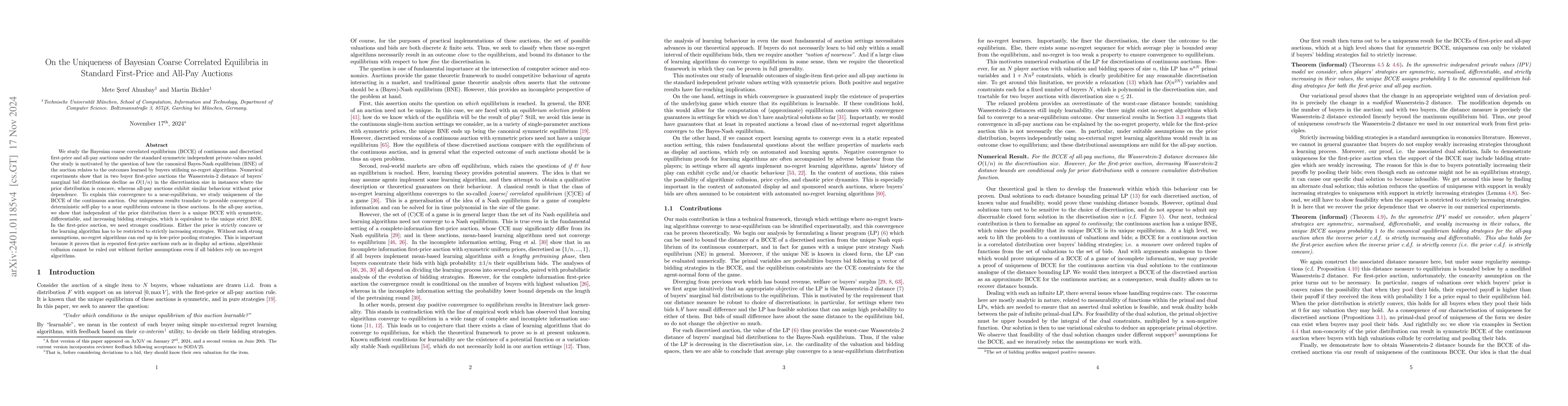

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the Computation of Equilibria in Discrete First-Price Auctions

Yiannis Giannakopoulos, Aris Filos-Ratsikas, Alexandros Hollender et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)