Summary

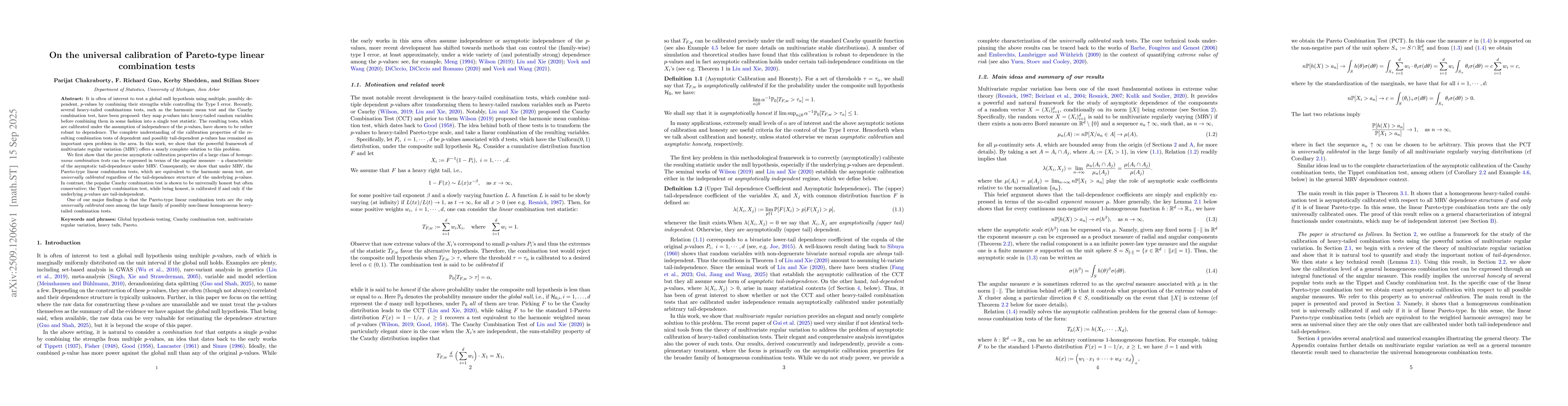

It is often of interest to test a global null hypothesis using multiple, possibly dependent, $p$-values by combining their strengths while controlling the Type I error. Recently, several heavy-tailed combinations tests, such as the harmonic mean test and the Cauchy combination test, have been proposed: they map $p$-values into heavy-tailed random variables before combining them in some fashion into a single test statistic. The resulting tests, which are calibrated under the assumption of independence of the $p$-values, have shown to be rather robust to dependence. The complete understanding of the calibration properties of the resulting combination tests of dependent and possibly tail-dependent $p$-values has remained an important open problem in the area. In this work, we show that the powerful framework of multivariate regular variation (MRV) offers a nearly complete solution to this problem. We first show that the precise asymptotic calibration properties of a large class of homogeneous combination tests can be expressed in terms of the angular measure -- a characteristic of the asymptotic tail-dependence under MRV. Consequently, we show that under MRV, the Pareto-type linear combination tests, which are equivalent to the harmonic mean test, are universally calibrated regardless of the tail-dependence structure of the underlying $p$-values. In contrast, the popular Cauchy combination test is shown to be universally honest but often conservative; the Tippet combination test, while being honest, is calibrated if and only if the underlying $p$-values are tail-independent. One of our major findings is that the Pareto-type linear combination tests are the only universally calibrated ones among the large family of possibly non-linear homogeneous heavy-tailed combination tests.

AI Key Findings

Generated Oct 02, 2025

Methodology

The research employs a combination of theoretical analysis and simulation studies to investigate the properties of multivariate regular variation and tail dependence coefficients. It builds on existing frameworks of extreme value theory and applies them to analyze the asymptotic independence of random variables.

Key Results

- Established that asymptotic independence in tails implies the vanishing of tail dependence coefficients

- Demonstrated relative compactness of tail measures for heavy-tailed random vectors

- Proved convergence of rescaled tail measures to limit measures concentrated on axes

- Extended results to random variables with both upper and lower regularly varying tails

Significance

This work advances understanding of extreme value theory by providing rigorous conditions for asymptotic independence in multivariate settings. The results have implications for risk management, reliability analysis, and statistical modeling of extreme events.

Technical Contribution

The paper provides rigorous mathematical proofs establishing the relationship between tail dependence coefficients and asymptotic independence, along with the convergence properties of rescaled tail measures in multivariate settings.

Novelty

This work introduces a comprehensive framework for analyzing multivariate regular variation with asymptotic independence, extending previous results to both positive and negative tails and providing explicit forms for limit measures.

Limitations

- Results are primarily applicable to heavy-tailed distributions

- Assumptions about tail behavior may not hold for all real-world datasets

- The analysis focuses on theoretical properties rather than practical implementation details

Future Work

- Explore applications in financial risk modeling

- Investigate dependence structures in higher dimensions

- Develop statistical tests for tail independence

- Extend to non-stationary and time-dependent processes

Paper Details

PDF Preview

Similar Papers

Found 4 papersNonparametric goodness of fit tests for Pareto type-I distribution with complete and censored data

Ananya Lahiri, Sudheesh K. Kattumannil, Avhad Ganesh Vishnu

On a new class of tests for the Pareto distribution using Fourier methods

L. Ndwandwe, J. S. Allison, M. Smuts et al.

Comments (0)