Summary

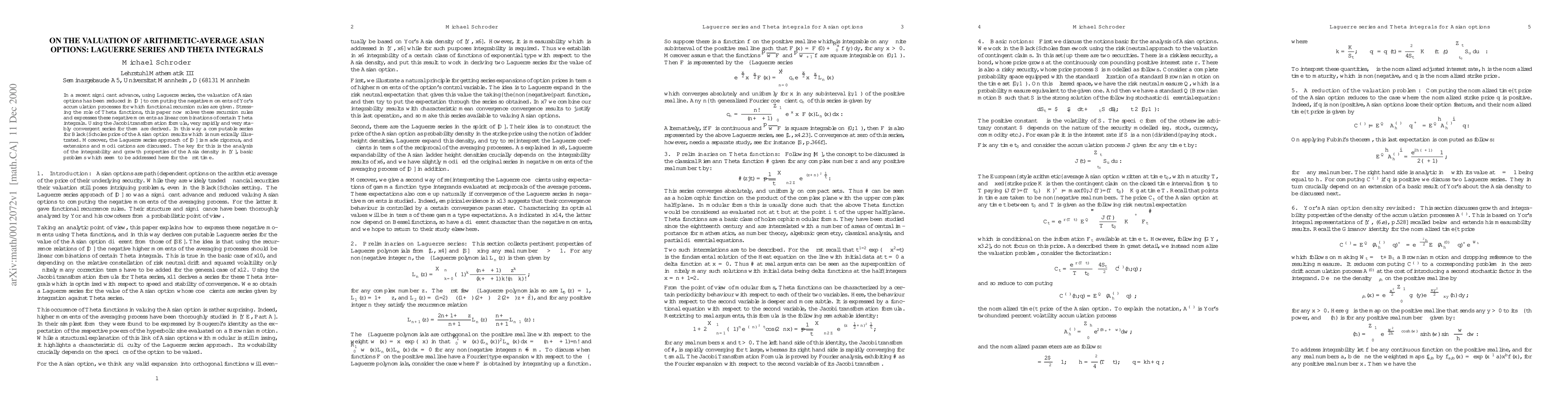

In a recent significant advance, using Laguerre series, the valuation of Asian options has been reduced by Dufresne to computing the negative moments of Yor's accumulation processes. For these he has given functional recursion rules whose probabilistic structure has been the object of intensive recent studies of Yor and co-workers. Stressing the role of Theta functions, this paper now solves these recursion rules and expresses these negative moments as linear combinations of certain Theta integrals. Using the Jacobi transformation formula, very rapidly and very stably convergent series for them are derived. In this way computable series for Black--Scholes price of the Asian option result which are numerically illustrated. Moreover, the Laguerre series approach of Dufresne is made rigorous, and extensions and modifications are discussed. The key for this is the analysis of the integrability and growth properties of Yor's 1992 Asia density, basic problems which seem to be addressed here for the first time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)