Authors

Summary

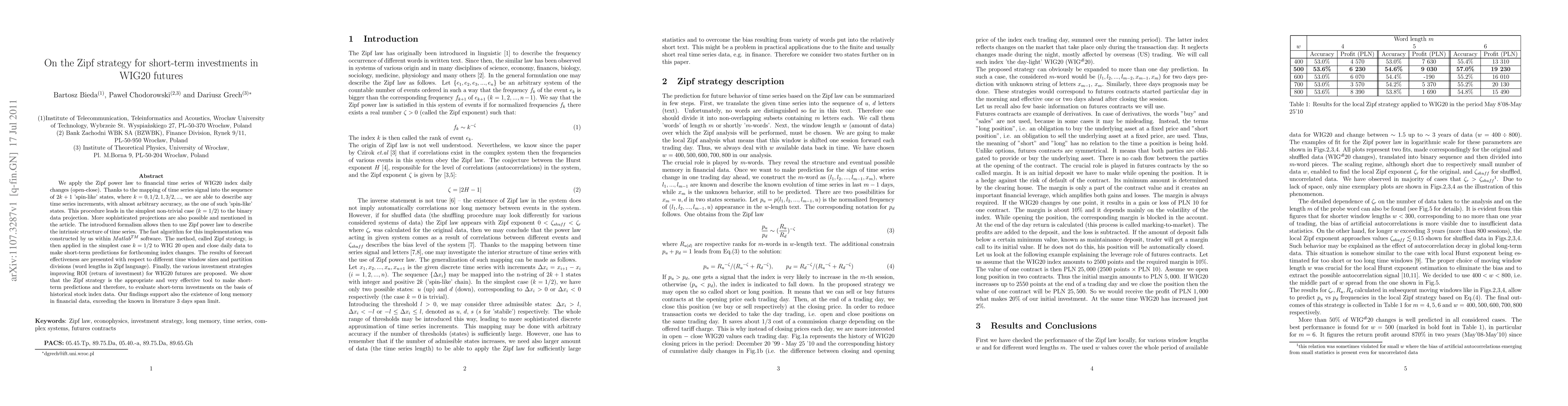

We apply the Zipf power law to financial time series of WIG20 index daily changes (open-close). Thanks to the mapping of time series signal into the sequence of 2k+1 'spin-like' states, where k=0, 1/2, 1, 3/2, ..., we are able to describe any time series increments, with almost arbitrary accuracy, as the one of such 'spin-like' states. This procedure leads in the simplest non-trivial case (k = 1/2) to the binary data projection. More sophisticated projections are also possible and mentioned in the article. The introduced formalism allows then to use Zipf power law to describe the intrinsic structure of time series. The fast algorithm for this implementation was constructed by us within Matlab^{TM} software. The method, called Zipf strategy, is then applied in the simplest case k = 1/2 to WIG 20 open and close daily data to make short-term predictions for forthcoming index changes. The results of forecast effectiveness are presented with respect to different time window sizes and partition divisions (word lengths in Zipf language). Finally, the various investment strategies improving ROI (return of investment) for WIG20 futures are proposed. We show that the Zipf strategy is the appropriate and very effective tool to make short-term predictions and therefore, to evaluate short-term investments on the basis of historical stock index data. Our findings support also the existence of long memory in financial data, exceeding the known in literature 3 days span limit.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)