Summary

The aim of this paper is to examine the time scaling of the semivariance when returns are modeled by various types of jump-diffusion processes, including stochastic volatility models with jumps in returns and in volatility. In particular, we derive an exact formula for the semivariance when the volatility is kept constant, explaining how it should be scaled when considering a lower frequency. We also provide and justify the use of a generalization of the Ball-Torous approximation of a jump-diffusion process, this new model appearing to deliver a more accurate estimation of the downside risk. We use Markov Chain Monte Carlo (MCMC) methods to fit our stochastic volatility model. For the tests, we apply our methodology to a highly skewed set of returns based on the Barclays US High Yield Index, where we compare different time scalings for the semivariance. Our work shows that the square root of the time horizon seems to be a poor approximation in the context of semivariance and that our methodology based on jump-diffusion processes gives much better results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

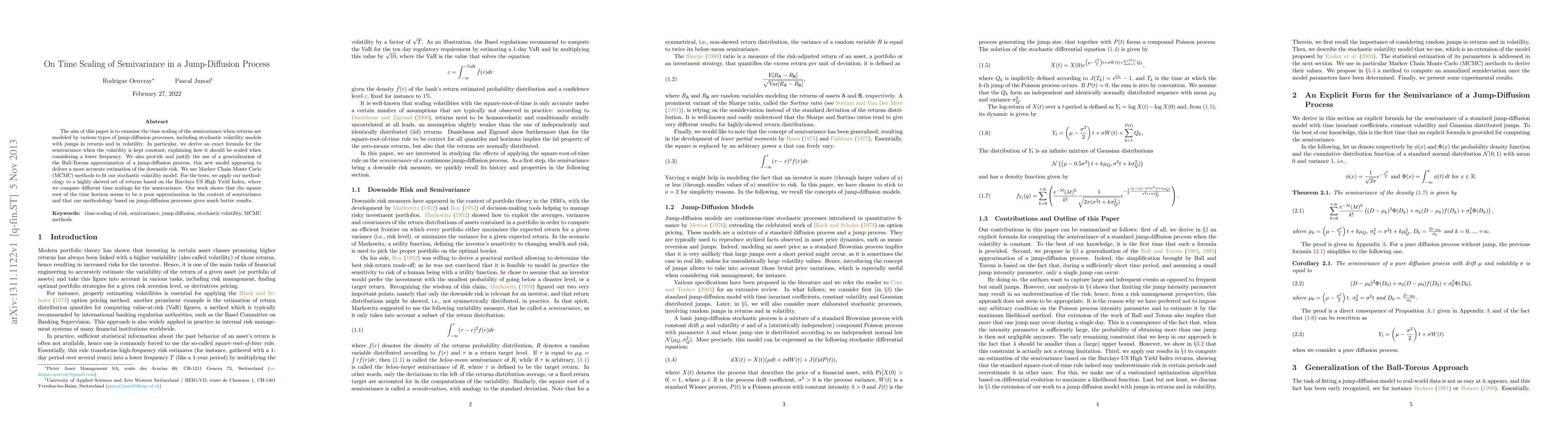

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)