Authors

Summary

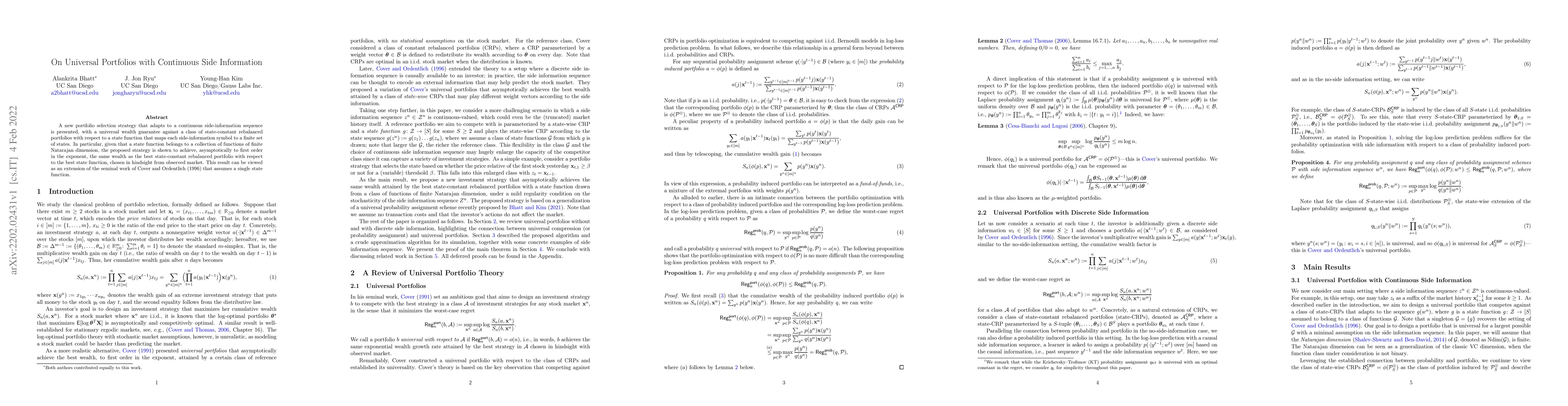

A new portfolio selection strategy that adapts to a continuous side-information sequence is presented, with a universal wealth guarantee against a class of state-constant rebalanced portfolios with respect to a state function that maps each side-information symbol to a finite set of states. In particular, given that a state function belongs to a collection of functions of finite Natarajan dimension, the proposed strategy is shown to achieve, asymptotically to first order in the exponent, the same wealth as the best state-constant rebalanced portfolio with respect to the best state function, chosen in hindsight from observed market. This result can be viewed as an extension of the seminal work of Cover and Ordentlich (1996) that assumes a single state function.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)