Summary

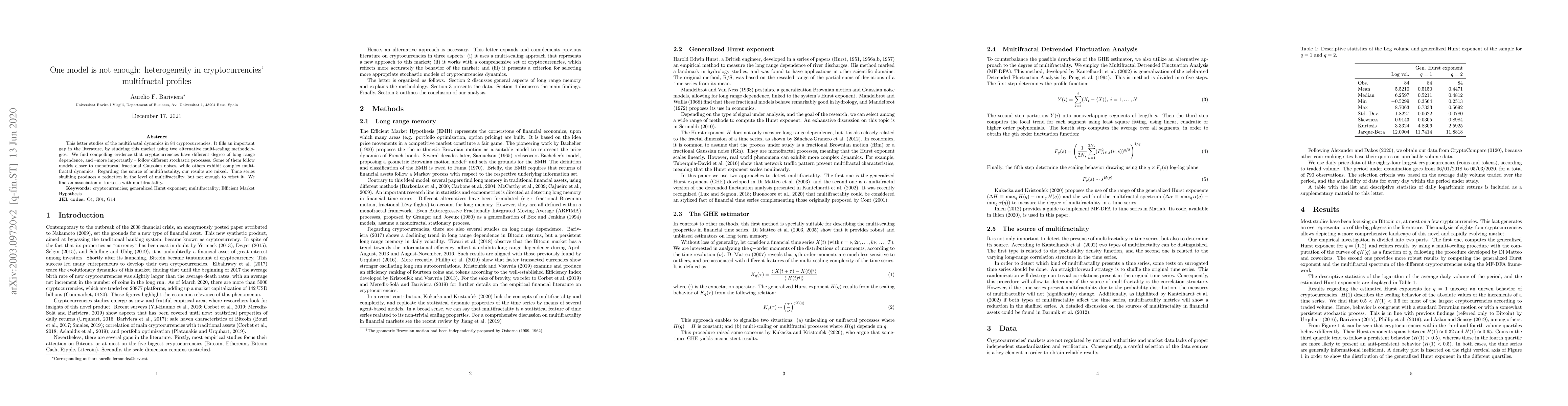

This paper studies of the multifractal dynamics in 84 cryptocurrencies. It fills an important gap in the literature, by studying this market using two alternative multi-scaling methodologies. We find compelling evidence that cryptocurrencies have different degree of long range dependence, and --more importantly -- follow different stochastic processes. Some of them follow models closer to monofractal fractional Gaussian noises, while others exhibit complex multifractal dynamics. Regarding the source of multifractality, our results are mixed. Time series shuffling produces a reduction in the level of multifractality, but not enough to offset it. We find an association of kurtosis with multifractality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHomogeneity and heterogeneity of cryptocurrencies

Xiao-Pu Han, Xiao Fan Liu, Zeng-Xian Lin

One stabilization is not enough for closed knotted surfaces

Sungkyung Kang, Kyle Hayden, Anubhav Mukherjee

| Title | Authors | Year | Actions |

|---|

Comments (0)