Authors

Summary

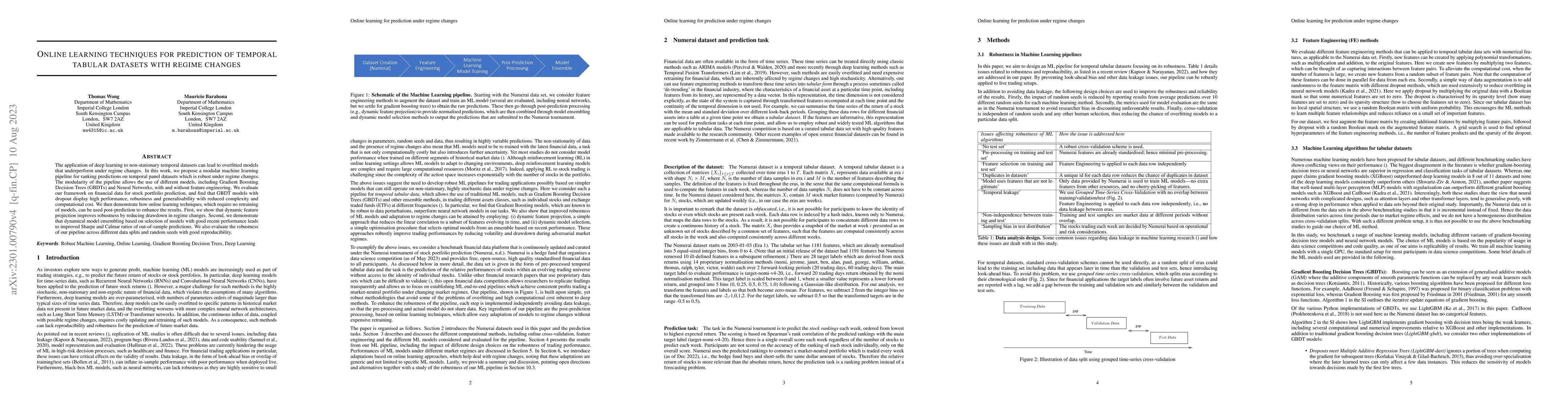

The application of deep learning to non-stationary temporal datasets can lead to overfitted models that underperform under regime changes. In this work, we propose a modular machine learning pipeline for ranking predictions on temporal panel datasets which is robust under regime changes. The modularity of the pipeline allows the use of different models, including Gradient Boosting Decision Trees (GBDTs) and Neural Networks, with and without feature engineering. We evaluate our framework on financial data for stock portfolio prediction, and find that GBDT models with dropout display high performance, robustness and generalisability with reduced complexity and computational cost. We then demonstrate how online learning techniques, which require no retraining of models, can be used post-prediction to enhance the results. First, we show that dynamic feature projection improves robustness by reducing drawdown in regime changes. Second, we demonstrate that dynamical model ensembling based on selection of models with good recent performance leads to improved Sharpe and Calmar ratios of out-of-sample predictions. We also evaluate the robustness of our pipeline across different data splits and random seeds with good reproducibility.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper proposes a modular machine learning pipeline for ranking predictions on temporal panel datasets, robust under regime changes. It evaluates Gradient Boosting Decision Trees (GBDTs) and Neural Networks with and without feature engineering on financial data for stock portfolio prediction.

Key Results

- GBDT models with dropout showed high performance, robustness, and generalizability with reduced complexity and computational cost.

- Dynamic feature projection improved robustness by reducing drawdown in regime changes.

- Dynamic model ensembling based on selecting models with good recent performance led to improved Sharpe and Calmar ratios of out-of-sample predictions.

Significance

This research is significant as it addresses the issue of overfitting in deep learning models applied to non-stationary temporal datasets, which often underperform under regime changes. The proposed framework offers a robust and computationally efficient solution for stock portfolio prediction.

Technical Contribution

The paper presents a modular machine learning pipeline incorporating online learning techniques for temporal tabular datasets with regime changes, demonstrating the efficacy of Gradient Boosting Decision Trees with dropout and dynamic model ensembling.

Novelty

The novelty of this work lies in its modular design that allows the use of different models and feature engineering techniques, combined with online learning methods to adapt to regime changes without retraining models.

Limitations

- The study was limited to financial data for stock portfolio prediction.

- The methodology's performance under other types of temporal datasets remains unexplored.

Future Work

- Investigate the application of this framework on other types of temporal datasets to assess its generalizability.

- Explore the integration of more advanced reinforcement learning techniques for online learning.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep incremental learning models for financial temporal tabular datasets with distribution shifts

Mauricio Barahona, Thomas Wong

TabGSL: Graph Structure Learning for Tabular Data Prediction

Cheng-Te Li, Jay Chiehen Liao

| Title | Authors | Year | Actions |

|---|

Comments (0)