Authors

Summary

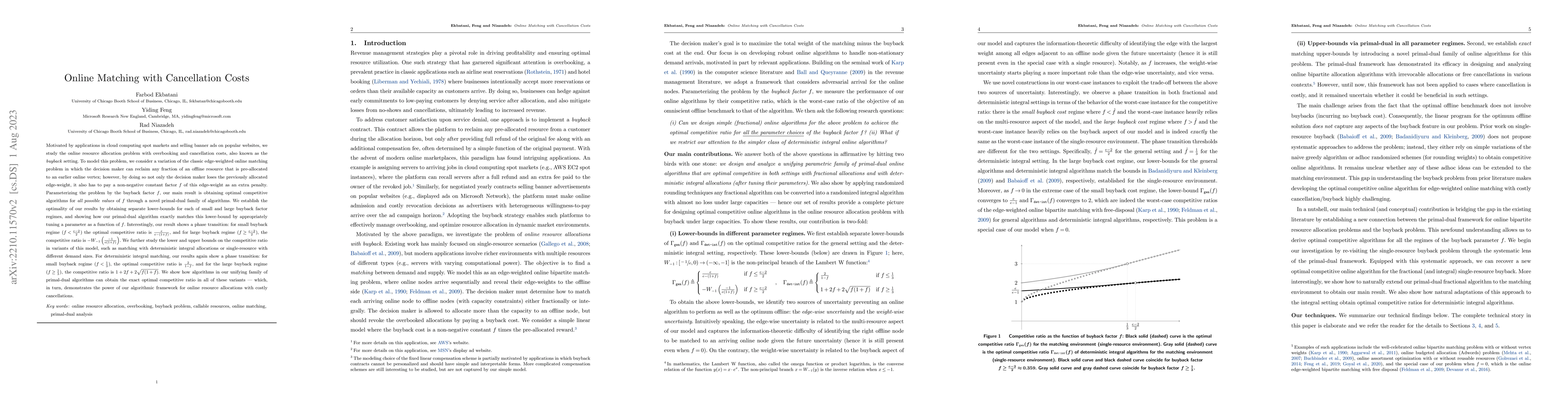

Motivated by applications in cloud computing spot markets and selling banner ads on popular websites, we study the online resource allocation problem with overbooking and cancellation costs, also known as the \emph{buyback} setting. To model this problem, we consider a variation of the classic edge-weighted online matching problem in which the decision maker can reclaim any fraction of an offline resource that is pre-allocated to an earlier online vertex; however, by doing so not only the decision maker loses the previously allocated edge-weight, it also has to pay a non-negative constant factor $f$ of this edge-weight as an extra penalty. Parameterizing the problem by the buyback factor $f$, our main result is obtaining optimal competitive algorithms for \emph{all possible values} of $f$ through a novel primal-dual family of algorithms. We establish the optimality of our results by obtaining separate lower bounds for each of small and large buyback factor regimes and showing how our primal-dual algorithm exactly matches this lower bound by appropriately tuning a parameter as a function of $f$. Interestingly, our result shows a phase transition: for small buyback regime ($f<\frac{e-2}{2}$), the optimal competitive ratio is $\frac{e}{e-(1+f)}$, and for the large buyback regime ($f\geq \frac{e-2}{2}$), the competitive ratio is $-W_{-1}\left(\frac{-1}{e(1+f)}\right)$, where $W_{-1}$ is the non-principal branch of the Lambert W function. We further study the optimal competitive ratio in variants of this model using our unifying framework, such as matching with deterministic integral allocations or single-resource with different demands. For deterministic integral matching, our results again show a phase transition: for small buyback regime ($f<\frac{1}{3}$), the optimal competitive ratio is $\frac{2}{1-f}$, and for the large buyback regime ($f\geq \frac{1}{3}$), it is $1+2f+2\sqrt{f(1+f)}$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOnline Matching with Delays and Size-based Costs

Yasushi Kawase, Tomohiro Nakayoshi

Online Matching with Convex Delay Costs

Yuyi Wang, Roger Wattenhofer, Xingwu Liu et al.

Online General Knapsack with Reservation Costs

Matthias Gehnen, Elisabet Burjons

Prophet Inequalities with Cancellation Costs

Pranav Nuti, Farbod Ekbatani, Rad Niazadeh et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)