Summary

The study of mechanisms for multi-sided markets has received an increasingly growing attention from the research community, and is motivated by the numerous examples of such markets on the web and in electronic commerce. Many of these examples represent dynamic and uncertain environments, and thus, require, in fact, online mechanisms. Unfortunately, as far as we know, no previously published online mechanism for a multi-sided market (or even for a double-sided market) has managed to (approximately) maximize the gain from trade, while guaranteeing desirable economic properties such as incentivizing truthfulness, voluntary participation and avoiding budget deficit. In this work we present the first online mechanism for a multi-sided market which has the above properties. Our mechanism is designed for a market setting suggested by [Feldman and Gonen (2016)]; which is motivated by the foreseeable future form of online advertising. The online nature of our setting motivated us to define a stronger notion of individual rationality, called "continuous individual rationality", capturing the natural requirement that a player should never lose either by participating in the mechanism or by not leaving prematurely. Satisfying the requirements of continuous individual rationality, together with the other economic properties our mechanism guarantees, requires the mechanism to use a novel pricing scheme where users may be paid ongoing increments during the mechanism's execution up to a pre-known maximum value. As users rarely ever get paid in reality, this pricing scheme is new to mechanism design. Nevertheless, the principle it is based on can be observed in many common real life scenarios such as executive compensation payments and company acquisition deals. We believe both our new dynamic pricing scheme concept and our strengthened notion of individual rationality are of independent interest.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

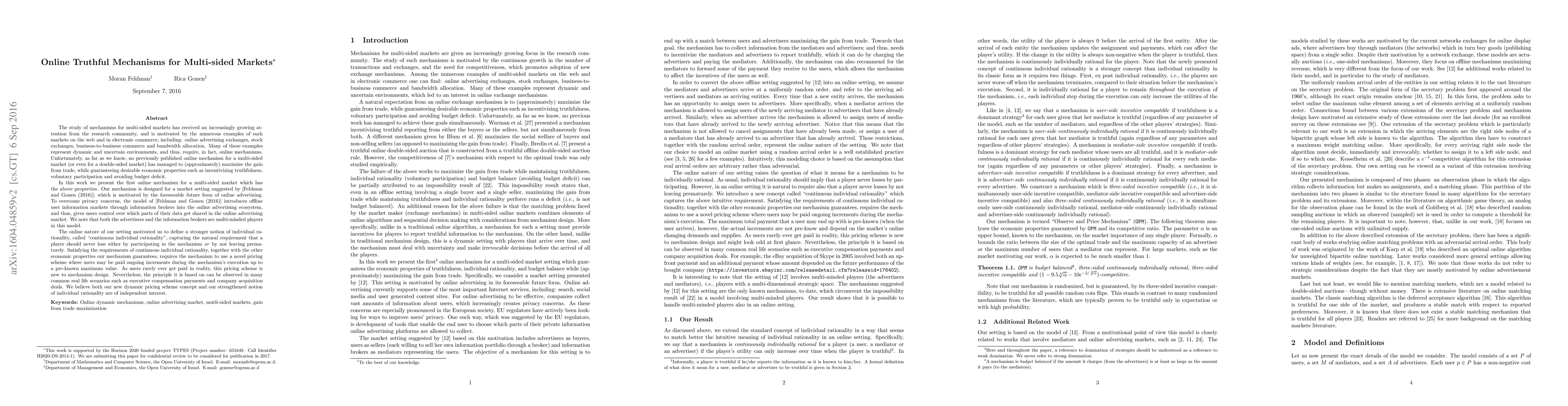

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)