Summary

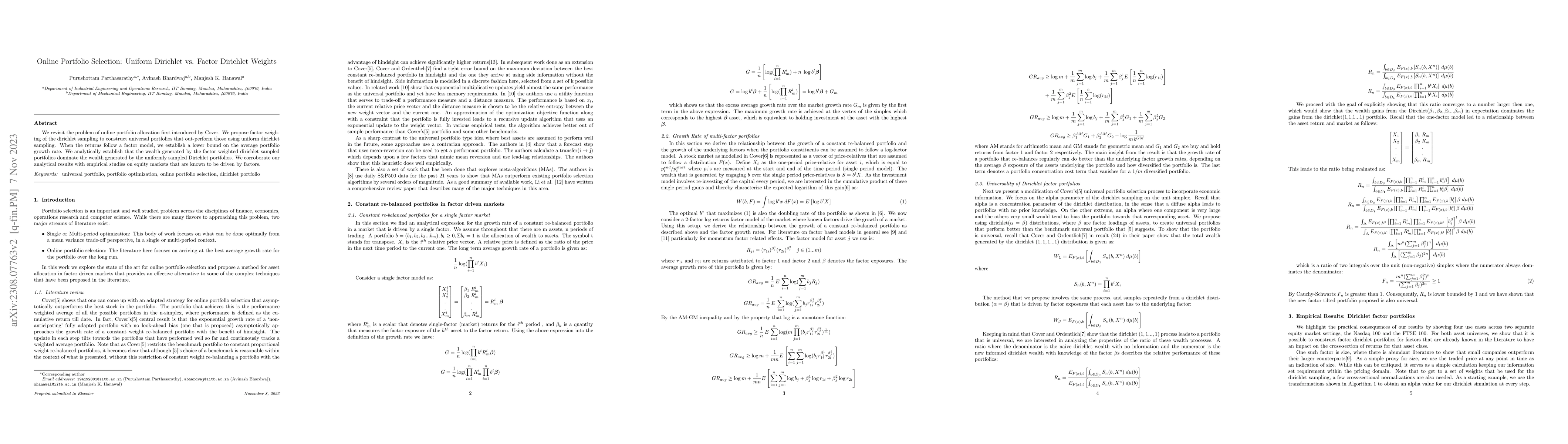

We revisit the online portfolio allocation problem and propose universal portfolios that use factor weighing to produce portfolios that out-perform uniform dirichlet allocation schemes. We show a few analytical results on the lower bounds of portfolio growth when the returns are known to follow a factor model. We also show analytically that factor weighted dirichlet sampled portfolios dominate the wealth generated by uniformly sampled dirichlet portfolios. We corroborate our analytical results with empirical studies on equity markets that are known to be driven by factors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)