Summary

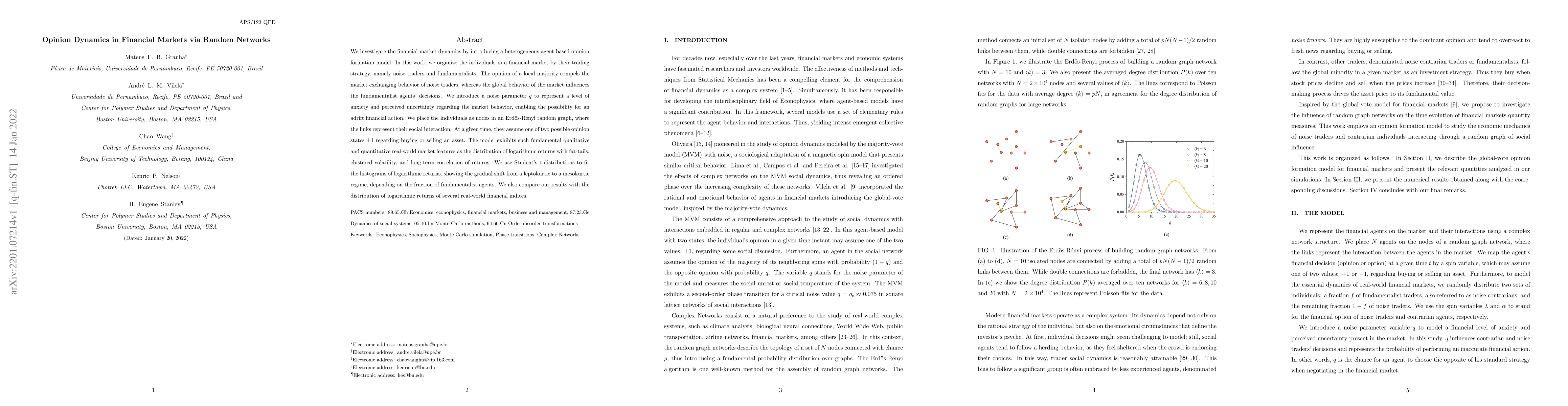

We investigate the financial market dynamics by introducing a heterogeneous agent-based opinion formation model. In this work, we organize the individuals in a financial market by their trading strategy, namely noise traders and fundamentalists. The opinion of a local majority compels the market exchanging behavior of noise traders, whereas the global behavior of the market influences the fundamentalist agents' decisions. We introduce a noise parameter $q$ to represent a level of anxiety and perceived uncertainty regarding the market behavior, enabling the possibility for an adrift financial action. We place the individuals as nodes in an Erd\"os-R\'enyi random graph, where the links represent their social interaction. At a given time, they assume one of two possible opinion states $\pm 1$ regarding buying or selling an asset. The model exhibits such fundamental qualitative and quantitative real-world market features as the distribution of logarithmic returns with fat-tails, clustered volatility, and long-term correlation of returns. We use Student's t distributions to fit the histograms of logarithmic returns, showing the gradual shift from a leptokurtic to a mesokurtic regime, depending on the fraction of fundamentalist agents. We also compare our results with the distribution of logarithmic returns of several real-world financial indices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThree-state Opinion Dynamics for Financial Markets on Complex Networks

Chao Wang, H. Eugene Stanley, Bernardo J. Zubillaga et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)